Price Action & Performance

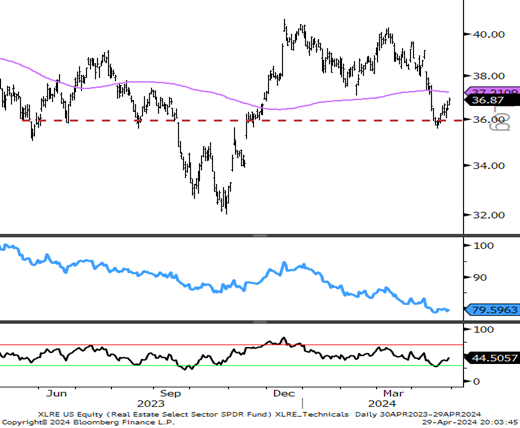

A somewhat hopeful end to 2023 turned out to be fool’s gold for XLRE investors as the nightmare continues for the Sector. Price action in absolute terms is at support, but relative to the benchmark S&P 500 performance continues to deteriorate.

Economic and Policy Drivers

Unfortunately there are good reasons for weak Real Estate performance in 2024. Persistently high interest rates are historically a head-wind to the sector. The Pandemic introduced a technology-enabled, cultural/behavioral head-wind in the form of “work-from-home” that has obliterated the marginal growth prospects of the Commercial Real Estate Industry. Recently weakness has accelerated in other industries within the sector as data centers (DLR, EQIX), tower stocks (AMT, CCI, SBAC) and self storage (PSA, EXR) have all seen prices tumble with the re-emergence of inflation.

How Can XLRE Help?

Like many sectors that have been long-term laggards, there is potential for reversal if pessimistic expectations go too low and stocks are able show strong sustained earnings power. When that pivot finally occurs a sector product like XLRE with exposure to all areas of the sector at a low cost is a great way to neutralize or go long a position. We go from a negative back drop for real estate to a positive one in two broad ways. Either inflation gauges like CPI start to relent taking pressure off the weakest areas of the sector, or inflation proves strong enough to tip the economy into recession with investors seeking the safety of fixed in come and high dividend stocks like REITs.

In Conclusion

XLRE has been a structural laggard since the bull market trend’s inception in early 2023. Unlike other historically defensive sectors, REITs in this cycle haven’t shown enough on the chart to get excited about. I would recommend a continued Underweight in XLRE for May.

Chart | XLRE Technicals

- XLRE has begun nascent bullish reversals in both absolute and relative terms