The continued bull trend and the lack of near-term inflation pressures may be whetting the appetite for bottom-fishing. We expect more bad news is priced in than good and have taken a modest long position in XLRE for July in our Elev8 Sector Model Portfolio.

Price Action & Performance

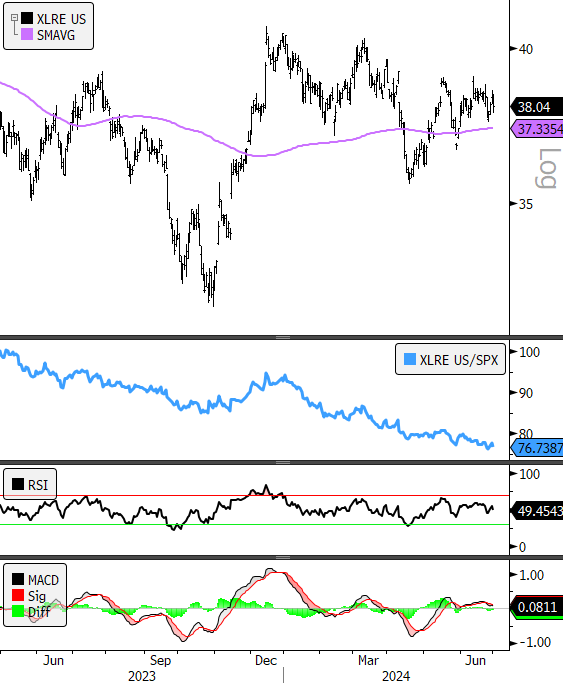

A somewhat hopeful end to 2023 turned out to be fool’s gold for XLRE investors as the nightmare continues for the Sector. Price action in absolute terms is in consolidation while relative performance vs. the S&P 500 is still weak. Reasons for a positive allocation have as much to do with the weakness manifesting in other lower vol. sectors than anything overtly positive about the XLRE, but there are some positive developments here as well.

XLRE posted 5 new 52-wk price highs in June and zero 52-wk lows. Oscillator work has shown some improvement with the MACD in positive territory since mid-May. Interest rates have corrected lower over the past two months despite yields backing up recently and commodities prices have been weak which historically has kept upside pressure off rates and input cost inflation. Performance is still negative, but that is no different than 8 other GICS Sectors.

Economic and Policy Drivers

Unfortunately there are good reasons for weak Real Estate performance in 2024. Persistently high interest rates are historically a headwind for the sector. The Pandemic introduced a technology-enabled, cultural/behavioral headwind in the form of “work-from-home” that has obliterated the marginal growth prospects of the Commercial Real Estate Industry. Recently weakness has accelerated in other industries within the sector as data centers (DLR, EQIX), tower stocks (AMT, CCI, SBAC) and self-storage (PSA, EXR) have all seen prices tumble with the re-emergence of inflation. It’s hard to find good charts or good stories in the Sector. SPG is the most hopeful chart we can find in the large cap. space. That said, there comes a point in any bear trend where the bad news has been “priced in”. There are technical signs that we may be at that point for XLRE. If the Fed. switches its policy stance on inflation we could see a reflationary rebound in the sector on optimism that lower rates can unlock some of the trapped potential in the sector, either by way of lowering potential redevelopment financing costs and by making the sector’s high dividend yield more attractive relative to peers.

How Can XLRE Help?

Like many sectors that have been long-term laggards, there is potential for reversal if pessimistic expectations go too low and stocks are able show strong sustained earnings power. When that pivot finally occurs a sector product like XLRE with exposure to all areas of the sector at a low cost is a great way to neutralize or go long a position. We go from a negative back drop for real estate to a positive one in two broad ways. Either inflation gauges like CPI start to relent taking pressure off the weakest areas of the sector, or inflation proves strong enough to tip the economy into recession with investors seeking the safety of fixed income and high dividend stocks like REITs. At present the former scenario seems more likely.

In Conclusion

XLRE has been a structural laggard since the bull market trend’s inception in early 2023. We’ve reached a point in the cycle where leadership is very narrow and only 2 Sectors have outperformed the S&P 500 YTD. In an 8-sector model that means there are some weak hitters in our lineup, but we will remain patient. We start July taking a modest OVERWEIGHT position in XLRE with our allocation +1.10% above the benchmark S&P 500 weight for the sector.

Chart | XLRE Technicals

- XLRE 12-month, daily price (200-day m.a. | Relative to S&P 500)

- XLRE continues to consolidate on absolute terms and lag relative to the S&P 500. We are expecting some speculative bottom-fishing in the sector as investors begin to discount a dovish Fed policy shift

Data sourced from Bloomberg