Price Action & Performance

XLK entered 2024 as undisputed leadership at the sector level. It is worth keeping in mind that XLK is the only sector of the 11 that had sustained outperformance over a secular time frame. The XLK has round tripped the S&P on a price basis over the past 10 years, outperforming by +102% over that time. For the sake of comparison, the Discretionary Sector has had the second-best track record. It has beaten the S&P 500 by +3% over that time frame. The takeaway should be clear. Shorting the sector materially is not something to be done lightly or for a long duration unless conviction is extraordinarily high. The sector has been THE dominant source of alpha generation.

Economic and Policy Drivers

Fed Policy on inflation is clashing with the dominant speculative theme of AI. While AI is potentially transformational, many Co’s that specialize in it are still in a Growth phase sporting elevated valuations vs. the broad market. Any increase in interest rate policy is likely to put downward pressure on high multiple Growth stocks. Another emerging headwind is foreign policy concern with China and new constraint for selling software, hardware and chips B2B and B2C to clients in China’s sphere of influence.

How Can XLK Help?

XLK offers exposure to some of the largest and strongest businesses in the world including AAPL, MSFT and NVDA. The XLK can help investors to manage exposure to this high momentum sector, so they can participate on the upside, and quickly sell exposure when tactical reasons emerge to do so as they have in the near-term. The Technology sector has made so many people so much money for such a long-time, that any big discount in the near-term will eventually be seen through the prism of opportunity as long as equities remain in any semblance of a bull market. Managing exposure with XLK can help when conditions change quickly. A portfolio can quickly go long or short the sector at a low cost to react to new information coming into the market. This month’s CPI report will likely be a use case. If inflation comes in light this month, I will be covering my tactical UW position for example, and can do so with as few as two transactions thanks to Sector SPDR’s.

In Conclusion

The XLF has improved steadily over the past 9 months. Deep discounting from the 2023 bank crisis has depressed sentiment, but slow, steady, sustained technical improvement at the sector level and some stand out areas. At this point, the outlook is for continued improvement. I would recommend a tactical -1% UW in XLK this month.

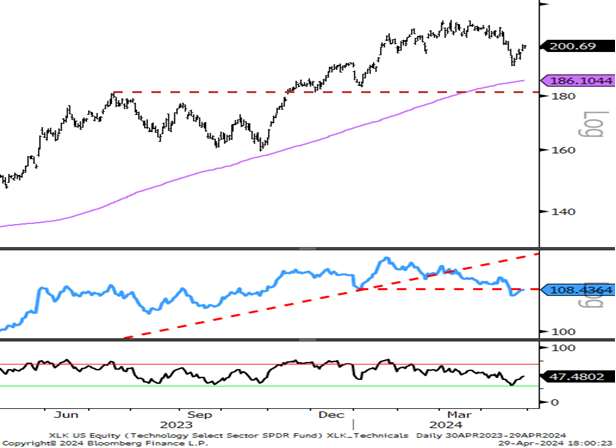

Chart | XLK Technicals

- XLK remains in a long-term uptrend, but is in the midst of a correction that sets up similarly to July-October of 2023. Structural support on the chart is at 180, -10% below today’s price

- In the middle panel, the relative curve vs. the S&P 500 had begun a negative divergence in late January giving a strong hint that consolidation was ahead