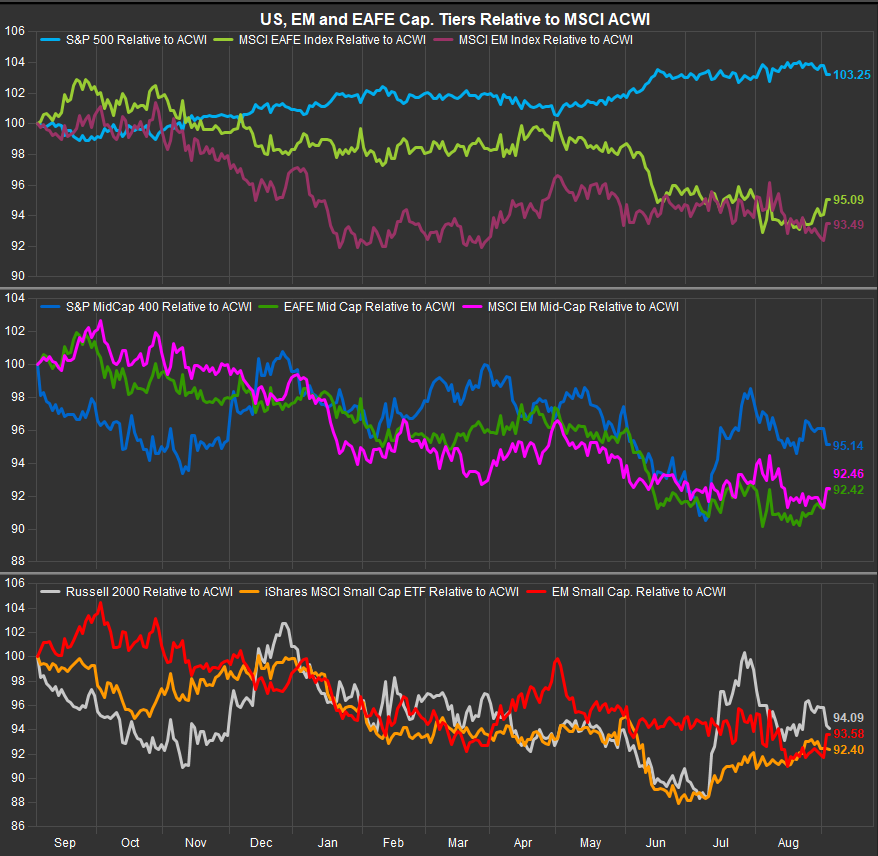

It’s been a few weeks since we looked at how equities are doing ex-US. We have been consistent in pointing out the weak performance of EM and EAFE indices relative to the S&P 500 as measured vs. the MSCI All Country World Index (ACWI). However, with the Fed embarking on policy easing and economic data showing some persistent weakness in the near-term, could there be a catalyst for trend change.

Tuesday saw a sharp uptick in ex-US relative performance vs. ACWI as the chart below shows. More follow-through is needed to show technical evidence of major trend change, but this development is worth watching. At present EAFE looks more promising than EM based on the behavior of its Relative curve over the past 6 weeks.

Looking into the Small and Mid-Cap. areas we are seeing EAFE Mid-Cap. and EM Small Cap. showing the biggest positive reactions to yesterday’s big drawdown in the US.

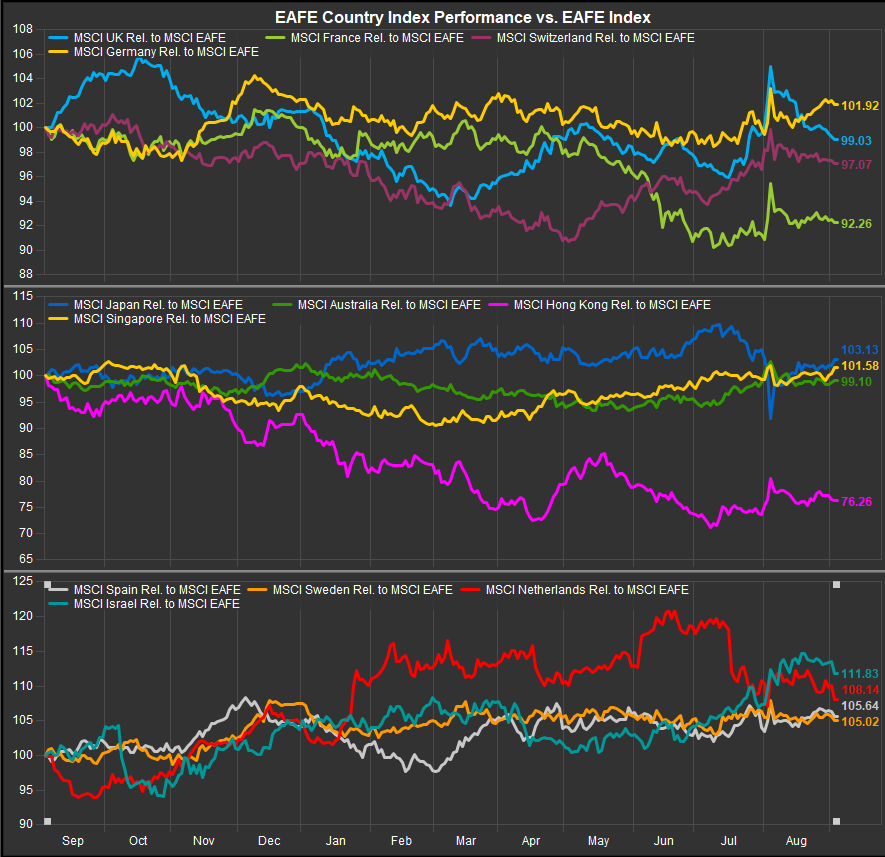

EAFE Country Constituent Performance

There is potential for EAFE to take on a leadership role if flagging US economic data continues to surprise to the downside. Moreover, with NVDA now in the regulatory crosshairs for anti-trust concerns, we are set up for periodic volatility from that angle as well.

Looking at the larger country constituents within the EAFE benchmark, we see Japan rebounding from its big correction in July/August to lead the majors in YTD performance. Australia and Singapore are showing improved performance over the intermediate-term, and the MSCI Israel Index broke out at the end of July, registering strong YTD gains.

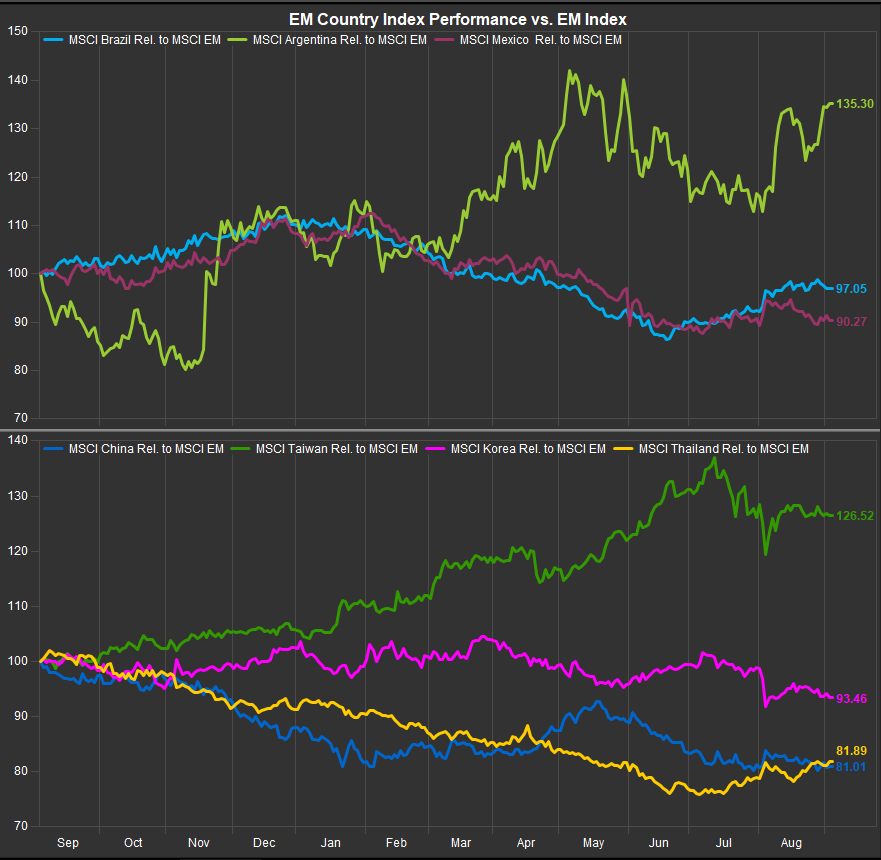

EM Country Performance

Looking at the EM side of the coin, we are seeing pockets of strength in Argentina, which continues to be the strongest country level performer inside the benchmark, and Taiwan. The latter is under some pressure in the near-term as Semiconductors correct. China continues to be weak, just as its DM surrogate Hong Kong has been a laggard vs. EAFE

Data sourced from FactSet Data Systems