Worldwide Wednesday, October 2, 2024

Near-term EM Outperformance the Headliner

The picture has finally changed for one area of ex-US equities. In short, stimulative policies out of China have reinvigorated EM share prices. EAFE shares haven’t seen a noticeable change in trend although performance has stabilized over the past two weeks.

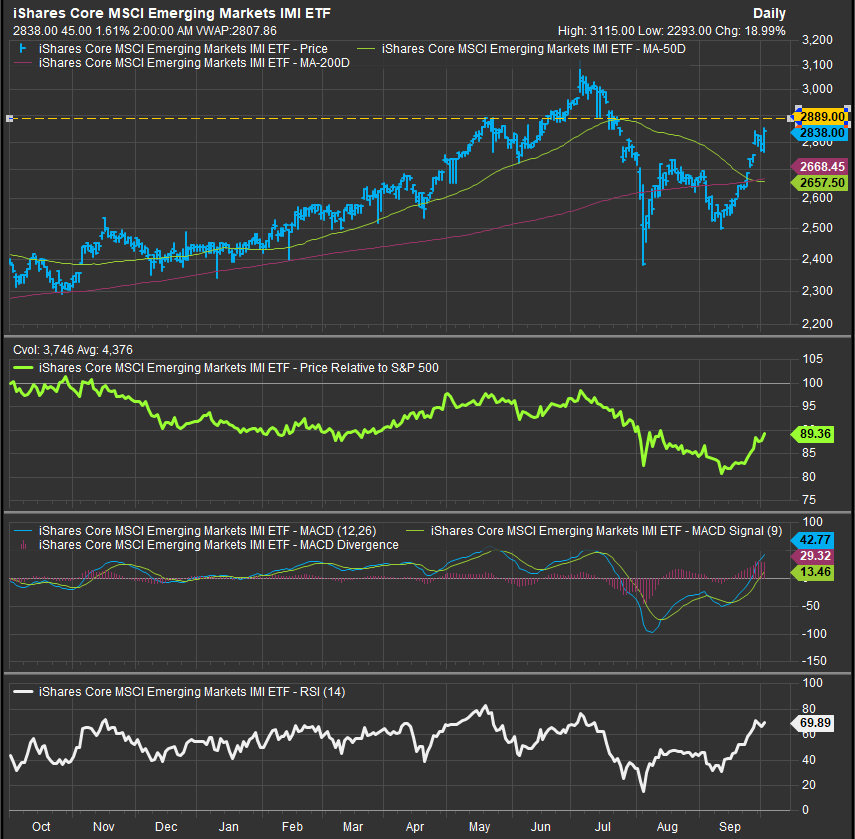

Prior to stimulative news on the Chinese economy, performance had been ramping in other EM countries. In the past week, Chinese shares have dominated the tape at the expense of other EM heavyweights. But, in aggregate, the EM index is now in a bullish reversal pattern against the MSCI All Country World Index, but also the S&P 500. Using the iShares Core MSCI EM ETF as a proxy, we expect the 2889 level to be a “tell” on the significance of the reversal. It is a lagging trend’s ability to move higher from traditional overbought levels that generates a trend-change signal, so while the near-term move is impressive, the more telling move for the longer-term trend comes next.

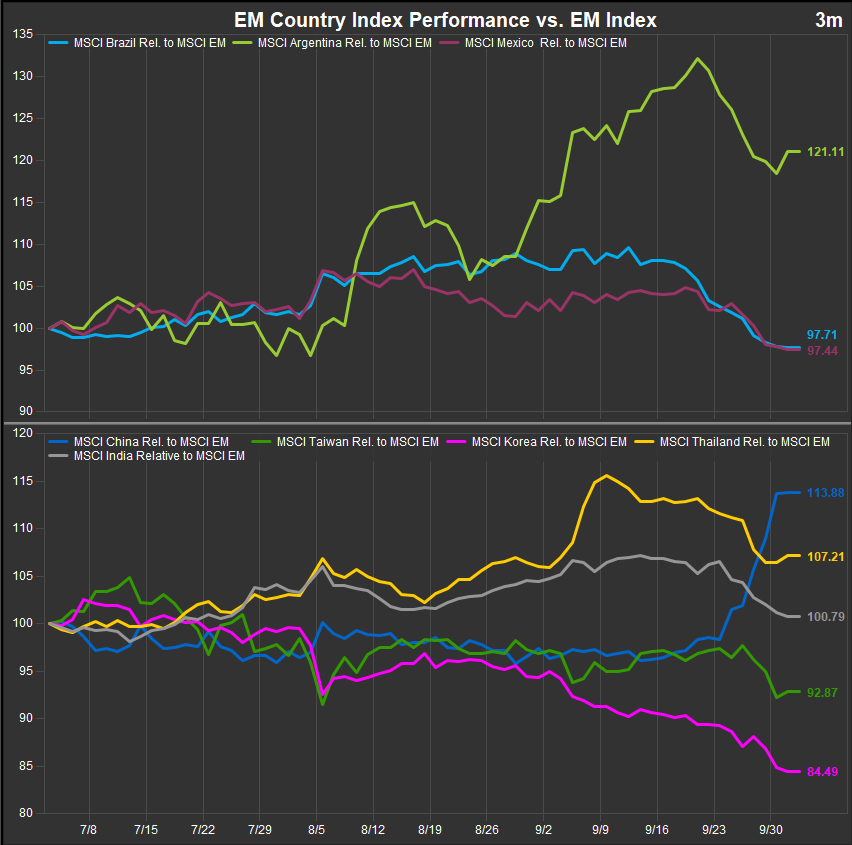

EM Country Performance

Chinese shares have dominated in the very near-term, but Thai and Argentine indices remain in bull trends despite rotation the last two weeks. Indian shares are threatening to turn negative and that may be part of the pivot if the bullish reversal in Chinese shares has legs.

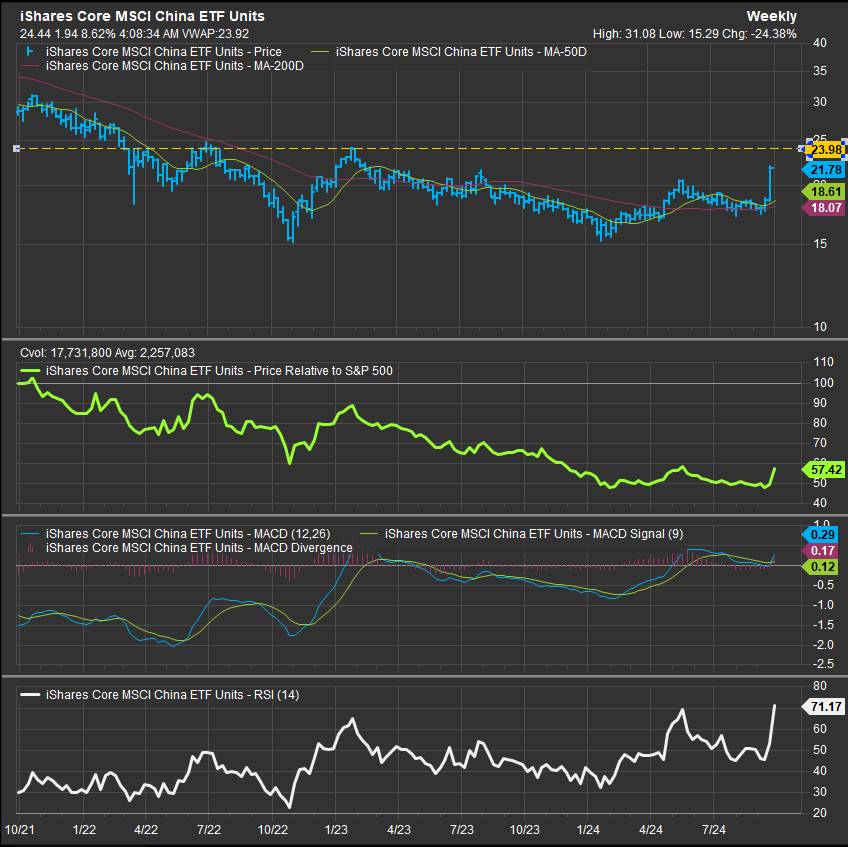

Despite the near-term excitement, we should keep in mind China’s equity performance has been incredibly weak over longer-term timeframes. Nonetheless, momentum surges are a key precursor to durable trend change and this price action has our attention. Using the iShares Core MSCI China ETF as a proxy we would point out that the bullish reversal would get much more real in our technical process with a move above $24.

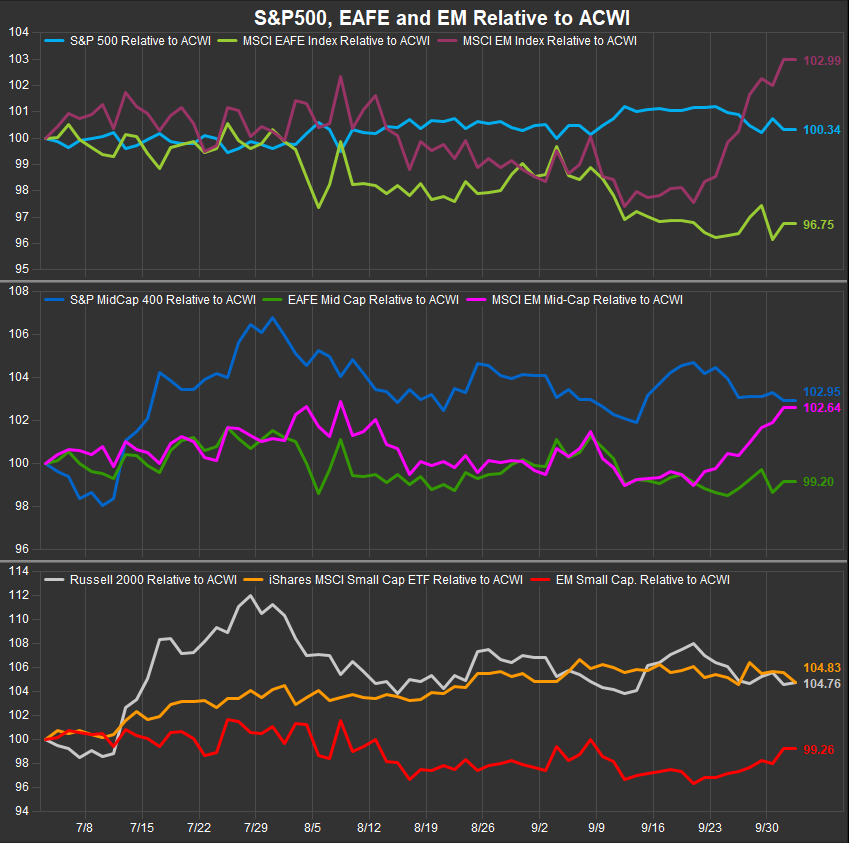

EAFE Can’t Take Advantage of a Pause in US Outperformance

Our Region and Market Cap. Level relative strength comparison shows EM small and Mid-cap. stocks also benefitting from the headline index turn around. He same has not held true for EAFE stocks which continue to be lackluster. EAFE Small Cap. shares (chart below, bottom panel) have been a lone bright spot in the region over the past 3-months.

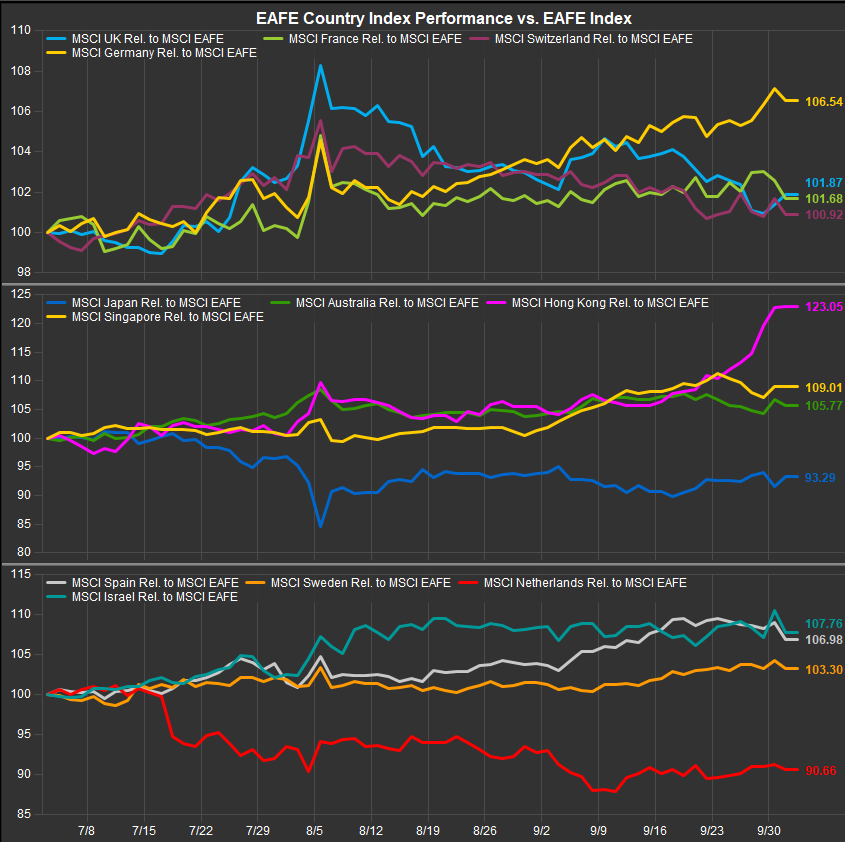

EAFE Country Performance Snapshot

Keeping in mind that our EAFE relative chart compares to the languishing EAFE Index, we can at least say that there is some dispersion to take advantage of as Japanese equity weakness has traded off against broad outperformance elsewhere. Hong Kong shares are a standout in the very near-term confirming alignment with Chinese equity performance. German shares have taken the baton for large country leadership. South Pacific region, Singapore and Australia country indices have shown strength along with Spanish and Israeli shares. The latter is holding onto gains despite an escalating war in the region.

Data sourced from FactSet Data Systems