ETF Insights| November 1, 2024 | Information Technology Sector

Price Action & Performance

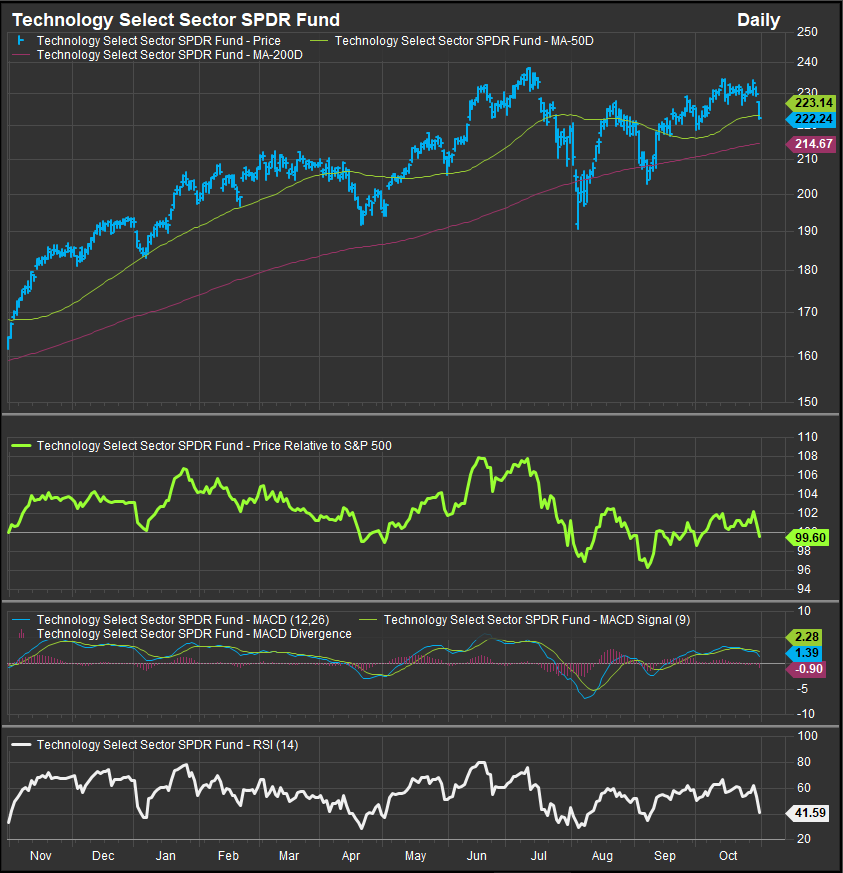

The XLK has continued to consolidate since making all-time price highs in July. The bullish reversal off the early August low continued to progress until the last two days of October where unsatisfactory earnings reports from the likes of MSFT, AMD, MPWR and others has put a damper on the re-emerging enthusiasm for the sector. We have some concern as to the lack of new relative highs since August, and we are seeing a sell signal in the MACD oscillator. Going forward we will be monitoring the 200-day moving average on our Tech Sector ETFs, as a downside violation of the longer-term trend proxy would put the sector in a vulnerable position.

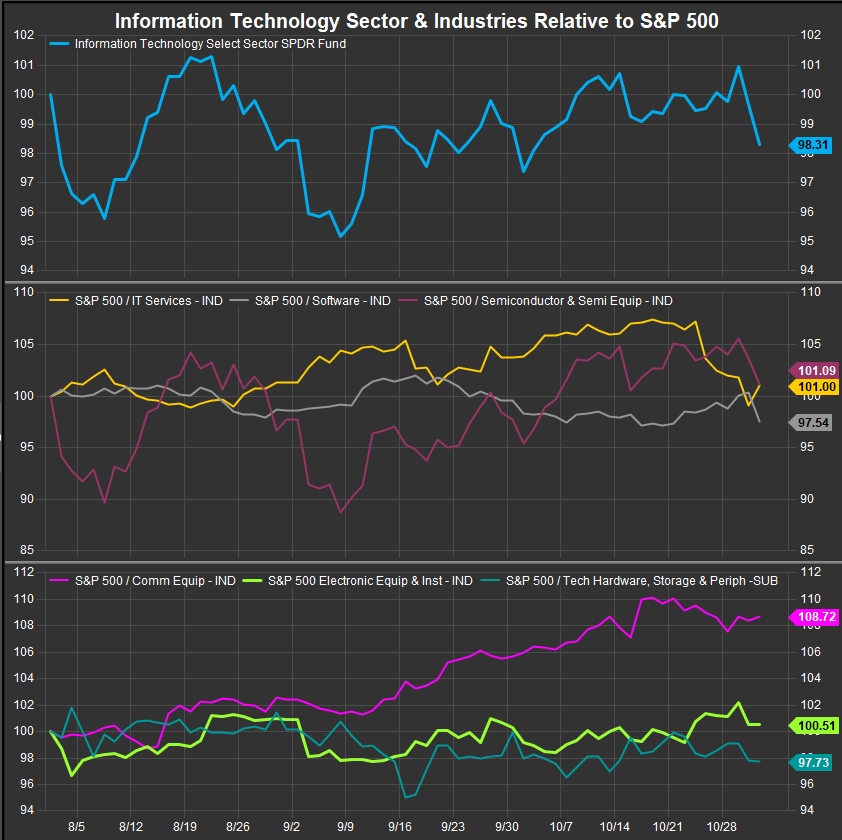

At the industry level, Semiconductors have stabilized performance and regained a bullish reversal structure since mid-September. Software and IT Services continue to correct and with Microsoft underwhelming on recent earnings, the former Industry has seen a big reversal in fortune after a strong 2023. Comm Equipment stocks have outperformed since June, While Electronics stocks are marginal outperformers.

At the stock level our favorite names are GDDY, ITT, FICO, ORCL, PANW, NOW, PLTR, TYL, ANET, GLW, ZBRA, AVGO, MPWR, NVDA. We remain constructive on AAPL as well along with several others.

Economic and Policy Drivers

To make a long story short, it appears investors are getting some “AI fatigue”. We had presumed this would be the case if tangible benefits to the technology were slow in accruing to its clients. That now appears to be happening as there remains robust interest, but investors are growing concerned that the bill keeps getting bigger and bigger. AI after all is supposed to increase efficiency, not burn the entire capital budget on machine learnings with no profit outcome. Investors have enjoyed the AI story, but it’s time for results.

The upcoming election also brings China into focus as it relates to the Tech sector. Taiwan Semiconductor remains the foundry of first choice for all of the best AI chips. Any saber-rattling in the Asia/Pacific region could add another complicated layer for equity investors to decipher.

In Conclusion

We are seeing some signs of “AI fatigue” in the stock charts that comprise the Technology Sector. As expected, there has been some reflation, but breadth measures in the Semiconductor space have narrowed and the Software industry is showing real vulnerability. We’ve scaled back our long to reflect these challenges. Our Elev8 Sector Model starts November with an OVERWEIGHT allocation of 1.38% for November.

Chart | XLK Technicals

- XLK 12-month, daily price (200-day m.a. | Relative to S&P 500 | MACD | RSI)

- XLK is consolidating its attempted bullish reversal. The bet here is this intermediate term consolidation will be accumulated sooner than later

XLK Relative Performance | XLK Industry Relative Performance | 3-Months

Data sourced from FactSet Research Systems Inc.