ETF Insights | February 2, 2025 | Information Technology Sector

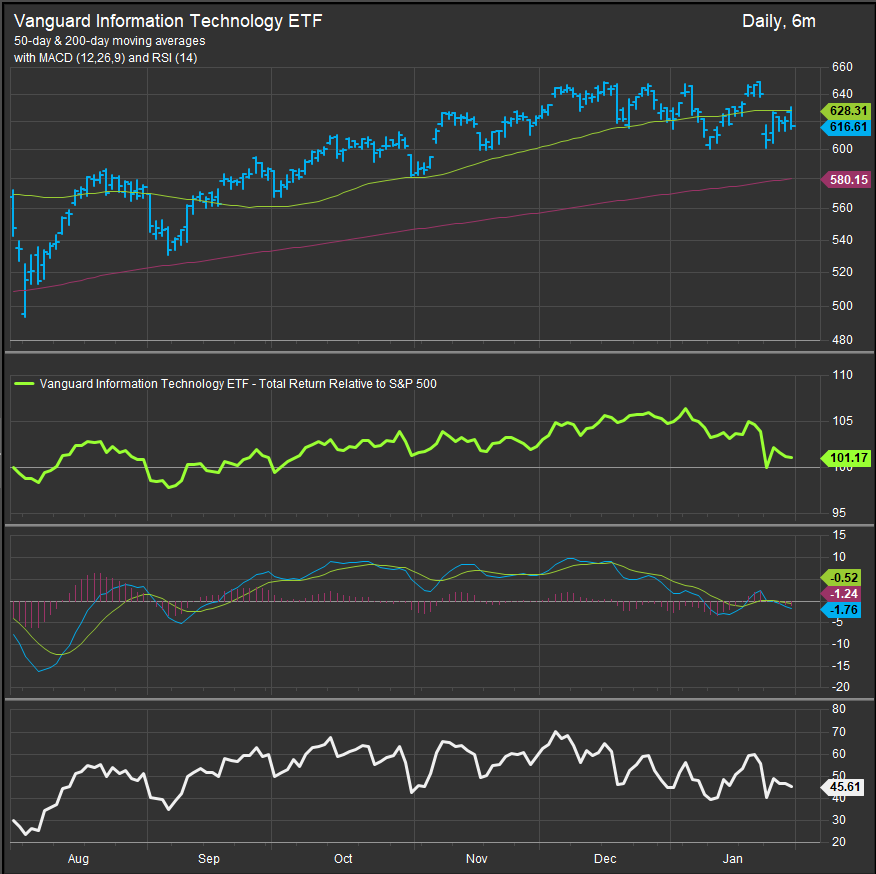

Large Cap. Technology Sector Price Action & Performance

We spent most of January on the wrong side of the Tech Sector and we got slapped around for it. Price action in the VGT (chart below) remains in a consolidation, but performance in January retraced the previous 5-months of gains and oscillator work is starting to show negative divergence in the near-term with the MACD also crossing over into downtrend territory.

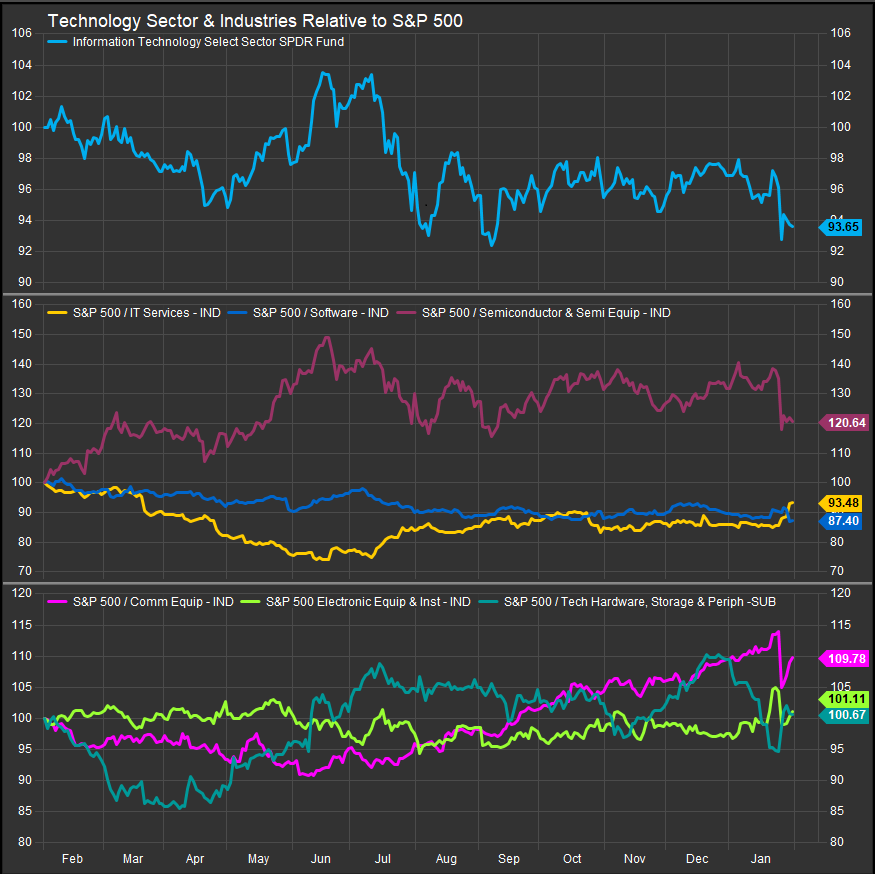

S&P 500 Technology Sector: Industry Performance Trends

Semiconductors continue to give back the past 12-month’s gains and have now underperformed over the trailing 6- month period. IT Services stocks have broken out to the upside, but that isn’t a very large industry anymore. Equipment stocks remain positive in our work, but they also took hits from the DeepSeek revelations.

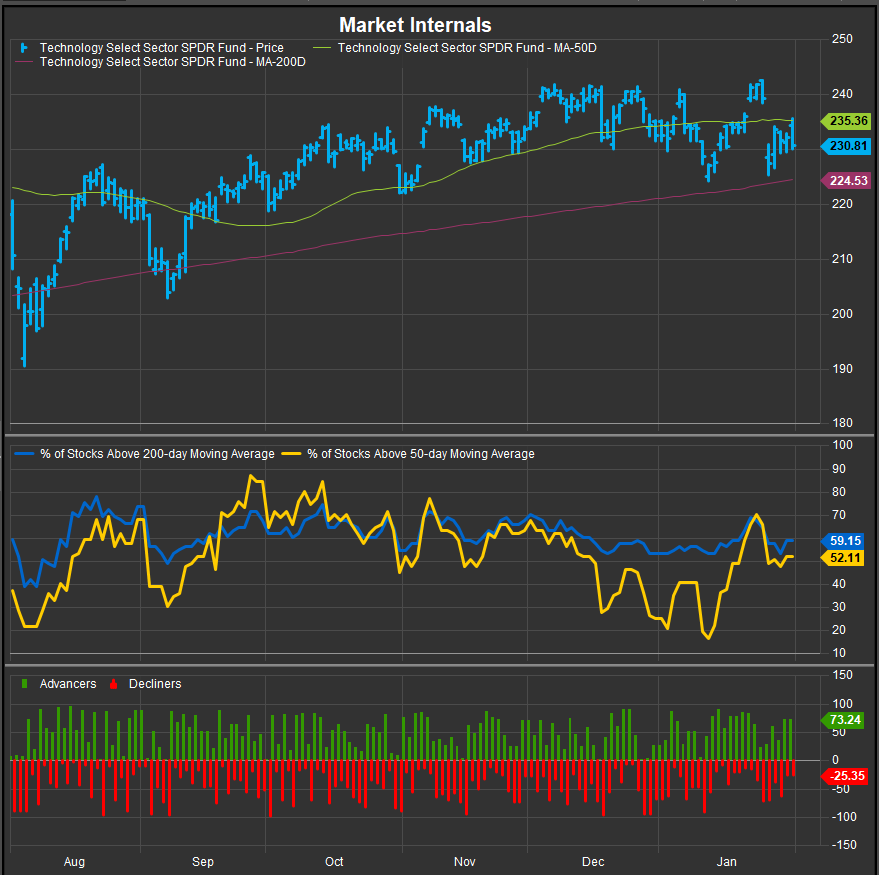

S&P 500 Technology Sector Breadth

Breadth has improved within the Sector since mid-January, but the % of stocks above their 200-day moving average (panel 2, dark blue line) continues to diverge negatively from price over the 6-months shown. Overall this is a weakening picture at present.

S&P 500 Technology Sector Top 10 Stock Performers

None of the usual suspects are on the list this month. LRCX is on the cusp of an upgrade in our rating process.

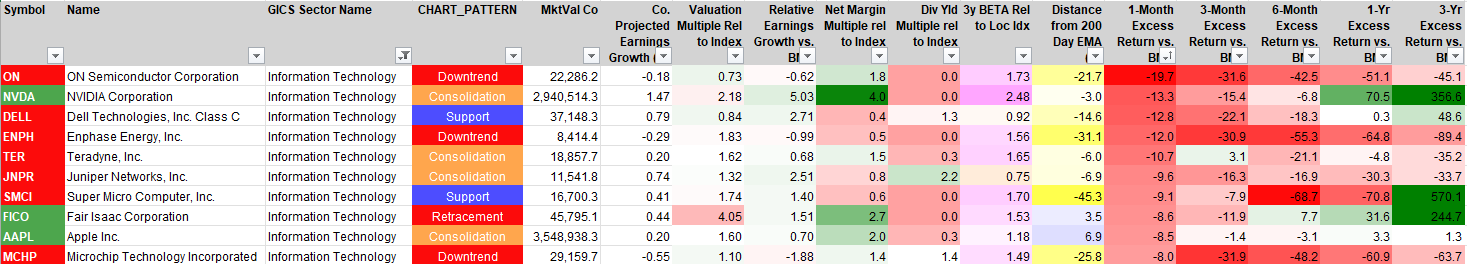

S&P 500 Technology Sector Bottom 10 Stock Performers

We are starting to see more long-term winners show up on the bottom-performers list. NVDA, AAPL, FICO (2 months in a row) and AAPL make the cut. This is starting to look like a sector in bullish to bearish transition.

S&P 500 Technology Sector Fundamentals

The chart below shows S&P 500 Technology Sector Margin, Debt/EBITDA, Valuation and Earnings. Some Margin compression in Q4 of 2024. Debt levels remain very low while current year valuations remain elevated with out year multiples still likely a premium to the S&P 500. EPS is expected to plateau after this coming year.

Economic and Policy Developments

The technology sector had a volatile January, with strong AI-driven momentum early in the month but renewed uncertainty around earnings, regulatory pressures, and global trade policies. While semiconductors and cloud computing saw strong demand, mixed earnings results and concerns over capital expenditures (capex) for AI infrastructure created volatility.

Big tech earnings dominated the headlines, with Microsoft (MSFT), Meta (META), and Apple (AAPL) reporting. AI remained the central investment theme, but concerns arose over the sustainability of hyperscaler capex and potential risks from China’s DeepSeek AI breakthrough. Additionally, Trump’s renewed tariff threats on semiconductors and technology components added fresh uncertainty to the sector, particularly for companies with China exposure.

Earnings & Key Developments in Tech

Microsoft (MSFT) reported strong results but disappointed investors with weaker-than-expected Azure growth and lack of reaffirmation for a second-half acceleration. Meanwhile, Apple (AAPL) delivered better-than-feared results, citing strong iPhone performance in regions where Apple Intelligence is available and positive effects from China’s economic stimulus.

The semiconductor sector saw a mixed performance. Nvidia (NVDA) declined after reports that the White House was considering restrictions on its H20 chips in China. However, Lam Research (LRCX) posted a strong quarter and raised guidance, citing NAND strength and above-market growth, while KLA Corp (KLAC) also beat expectations. Intel (INTC) saw a strong Q4 but issued a weaker outlook, sparking concerns about future demand.

In software, Atlassian (TEAM) surged after strong cloud and data center performance and a better-than-expected guidance boost. ServiceNow (NOW) underwhelmed despite a beat, with soft guidance weighing on sentiment. IBM (IBM) impressed investors with AI-driven growth in software and an upbeat free cash flow outlook.

Cybersecurity firms saw solid growth, with Check Point Software (CHKP) beating expectations and highlighting strong demand for AI-enhanced security solutions. Meanwhile, datacenter spending remained robust, but investors are closely watching how AI investments impact traditional cloud growth.

Policy & Economic Developments Affecting Tech

The Federal Reserve’s decision to hold rates steady was widely expected, but the hawkish language in its statement weighed on tech stocks early in the month. While markets still expect the first rate cut in June, rising Treasury yields and concerns over inflationary pressures created headwinds for growth-oriented tech companies.

Trade policy became a renewed source of uncertainty. Trump announced plans to implement 25% tariffs on semiconductors, steel, and tech components by mid-February, sparking concerns about supply chain disruptions and rising costs for chipmakers. The administration also floated potential regulatory actions against major AI and cloud players, with reports indicating the White House may tighten export controls on Nvidia chips to China.

China’s DeepSeek AI breakthrough fueled fresh debates on US dominance in artificial intelligence. Reports suggested Microsoft and OpenAI were investigating whether DeepSeek had improperly obtained OpenAI data, while Alibaba (BABA) claimed its AI model surpassed DeepSeek’s capabilities. These developments raised concerns about potential US policy responses, including further chip export restrictions.

Meanwhile, Trump’s consideration of tax cuts and deregulation could provide a longer-term boost to the sector, though details remain uncertain. The potential for federal restrictions on AI models trained on public data is also under discussion, which could impact companies like OpenAI, Google, and Meta.

February Outlook

Looking ahead to February, AI investments, big tech earnings, and trade policy developments will be key drivers of the sector. Companies will need to address concerns over AI-related capex spending, efficiency improvements, and long-term monetization strategies.

Overall, the technology sector remains a growth leader, but risks around AI capex sustainability, trade policy, and interest rates could contribute to continued market swings. Investors will be looking for clarity on AI monetization, regulatory headwinds, and earnings momentum to determine whether the recent pullback is a buying opportunity or a sign of deeper challenges ahead.

In Conclusion

We think equity investors will likely continue to focus on headwinds to the Tech sector in February. We start the month with the Technology Sector as an underweight position of -7.23% vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Note: We have modified our sector fund selection criteria to use the largest US-based sector funds by AUM in our portfolio construction process. For Technology and Real Estate we use Vanguard Funds which include a slightly broader MSCI benchmark to replicate the sectors as compared to Sector SPDR funds which are bench marked to Standard & Poors Indices. However, our analytic process for the sector uses data from provided by S&P and we site the different headers as “S&P 500” and “Large Cap.” to reflect the difference.

Data sourced from Factset Research Systems Inc.