March 23, 2025

The S&P 500 continues in correction territory with prices consolidating just above recent lows at the 5509 level. We expect the current rally to fail between the 50-day and 200-day moving averages as the former corresponds with overhead congestion on the chart (below). We think there is further downside due the formation of recent lower lows on our MACD and RSI momentum studies (chart, panels 2 & 3), as corrective moves typically taper off on receding momentum readings (positive divergence). However, while we rely on technical indicators to help us position with the strongest trends in the market, we also need to keep in mind that we are in a somewhat binary economic scenario with regard to tariffs.

A certain amount of bad news has been priced into the equity market as the initial pronouncements on tariff policy have been digested. Moving forward, further revelations are going to fit a pattern of being worse than expected or better and we will likely see equities act accordingly. I bring this up to point out that expectations arising from the research discipline (in our case technical analysis) need to be filtered through the lens of the practical scenarios that are impacting market behavior. If we see some kind of about-face on policy, equities could be in line for some bullish relief. Long story short, things can change quickly, but absent new catalysts, the technical picture shows the bear remains in control.

This week we will take a look at the performance of riskier, more speculative assets to see if anyone is getting interested in accumulating recently discounted prices.

Old Leadership, Current Leadership, New Leadership…

Our bull trend from 2023 through 2024 had an obvious leadership profile. Mega Cap. Growth, followed by Large Growth and Mid Growth. And we’ve seen in 2025 that everything but Growth is outperforming while equities retrace gains. We’re conscious of the fact that significant corrections often come with rotation to new leadership as well. We expect a durable bottom comes when investors start perceiving value in the most heavily discounted stocks associated with the previous regime, and likely a new coalition of stocks will emerge. From our view rates have to stay in check or the Consumer isn’t going to make it too much further through the cycle, so we want to see rates lower and Growth areas rebounding.

The Consumer Needs Lower Rates

The Consumer has been under pressure recently. Whether looking at Apparel, Autos, Homebuilders or Specialty Retail stocks, enthusiasm for consumer prospects has disappeared. The housing market is exhibit A, as higher rates have dampened demand to the point that new orders are at risk and inventory is sitting despite a housing shortage in the country.

The chart of the US 10yr Yield shows the 4.17% level as a key potential pivot for rates. A move below implies a retest of longer-term support at 3.5-3.6%. We think that’s where rates have to get to and stay to provide a salve for the US Consumer.

Previous Leaders Still Lag

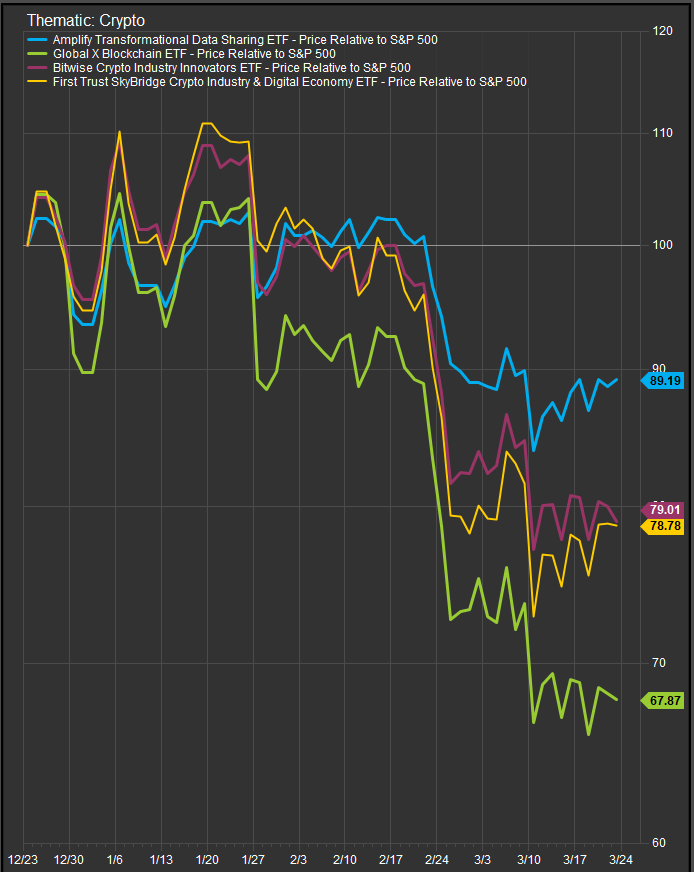

In the meantime, we will be looking for signs of resiliency in other financial assets that are useful gages of risk appetite. Below is an assortment of the largest Crypto ETFs and their performance relative to the S&P 500. Over the past week there have been some signs of consolidation/stabilization in the performance curves of these ETFs with the Amplify Transformation Data Sharing ETF (BLOCK) the closest to near-term bullish reversal.

The Roundhill Mag7 chart (below) is consolidating near the October 2024 lows. The more price continues to move sideways, the move we would expect it to resolve lower in the near-term.

New Leadership Potential

One area where we are seeing outperformance on the near-term bounce is investment banks and asset managers. These stocks were very strong in the previous bull and are being more vigorously defended at their respective 200-day moving averages. The chart of Morgan Stanley (below) is an example, but we’re seeing the same in names like GS, APO and BLK. We’ve been interested in the potential for Financials to lead equities for the past few months as the mounting cross currents for equities and fixed income puts the sector in position to facilitate a lot of trading while private wealth credit facilities offer more ways to lend than have previously been available when government credit is constrained.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.