ETF Insights| November 1, 2024 | Financial Sector

Price Action & Performance

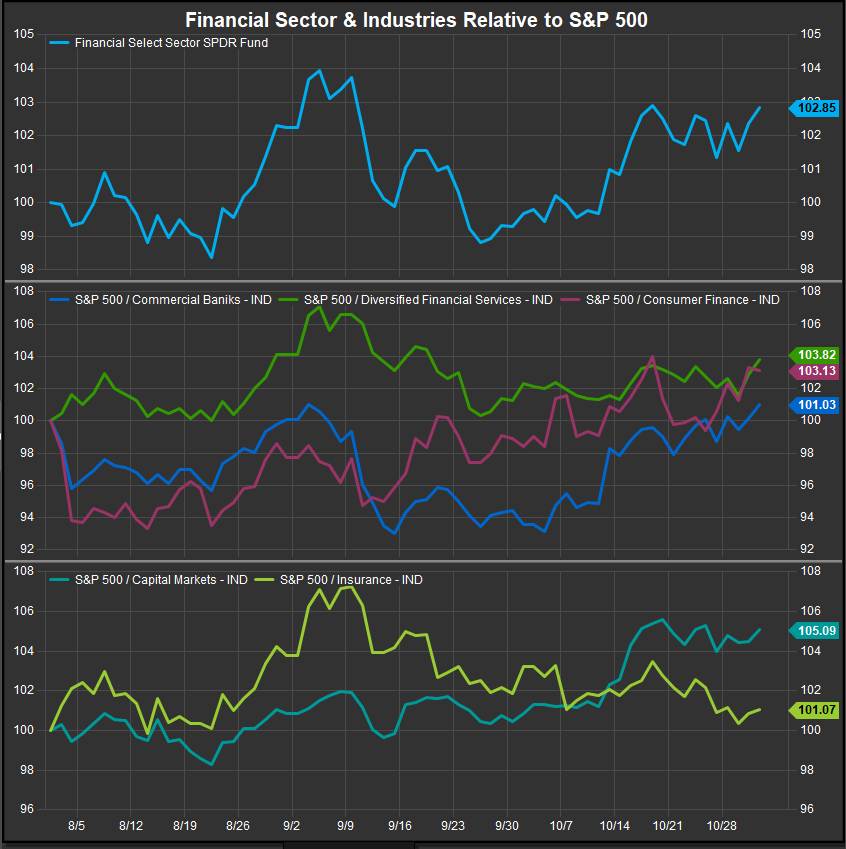

The Financial Sector bounced to the upside from September’s consolidation and enters November among the sector leadership cohort. Oscillator work shows the MACD on a buy signal and the RSI near-term momentum gage in a neutral position. Corrective action from this past summer is now in the rearview mirror and the sector chart as proxied by XLF remains in an uptrend in absolute terms and an established bullish reversal relative to the benchmark S&P 500 Index.

At the Industry level, Banks, Consumer Finance and Capital Markets industries represent leadership while Diversified Financials Services (primarily Berkshire Hathaway) and Insurance industries saw performance flat to down for the month. This fits with the general “risk on” tone in October, though as we write this, the month is ending with a thud. That said, looking back longer term, sustained underperformance in 2023 has furnished a setup for the sector that implies more upside in performance going forward.

At the stock level we have noted steady improvement from commercial banks, with the regionals showing strong charts. Among money-center banks, JPM is clearly the best over BAC, C and WFC. Our favorite stocks reside in the Consumer Finance and Capital Markets industries. Our best ideas include AXP, COF, SYF, KKR, BX, GS, FI and FIS. Insurance names, which had been leadership until recently now look like they are rolling over in aggregate which may be a sign that investors are moving up the risk curve to align with Fed policy and the sustained bull trend in equities.

Economic and Policy Drivers

Lower inflation readings have helped reflate many bank balance sheets which had been over-indexed to the long end of the curve back in 2022. Investors have pivoted to expecting interest rate policy easing from the Fed. in the 2nd half of 2024 and the Fed confirmed resoundingly with an initial 50bp cut in September. We are seeing historical upside exposures start to assert themselves on the tape as interest rates stabilize in the near-term.

However, October has brought some complicating factors in the form of Yields that are rising despite the Fed’s policy objectives and guidance on future rate cuts. The Fed now faces the potential for a policy mistake if it goes too soft on inflation, and it also becomes on open question as to whether dovish policy will in fact lower borrowing costs for a cash strapped consumer if investors are selling bonds and forcing rates higher to position for bull markets or for inflation.

Regarding the upcoming election, Financials will likely benefit from any momentum the Trump campaign can gain as election season ramps given his legacy of cutting taxes for the wealthiest and easing regulatory hurdles for businesses. Interest rates remain a key pivot as broadening upside participation in the equity market may spark bets on a reemergence of inflation, but so far that concern is on the periphery.

The biggest issue facing the sector likely remains the level of interest rates and the consumer’s ability to keep spending. As rates elevate near-term, we need to keep an eye of default rates for credit cards, auto loans and home loans as there was evidence of the Consumer getting overleveraged before the Fed stepped in with policy help.

In Conclusion

The Financial Sector persists in a strong YTD uptrend and stock and industry level performance continues to show broad participation to the upside. Our Elev8 Sector Model continues with an OVERWEIGHT Position in XLF of +3.45% vs. the benchmark S&P 500

XLF Technicals

- XLF daily (200-day m.a. | Relative to S&P 500 | MACD | RSI )

- Relative-curve is back near highs for the year. We expect some momentum to carry forward amidst bullish oscillator readings

XLF Relative Performance | XLF Industry Level Relative Performance | 3-Months

- XLF has seen a broad near-term pull back in relative strength but the longer-term bullish reversal remains intact

Data sourced from FactSet Research Systems Inc.