US equities closed mixed on Wednesday. The Dow rose 0.09%, while the S&P 500, Nasdaq, and Russell 2000 all saw slight declines. Stocks tried to rebound but failed to hold gains after the S&P 500’s significant drop on Tuesday, the third worst of the year. Treasuries rallied with a steepening yield curve, and the 2/10 spread fully un-inverted. The dollar index dropped 0.5%, gold edged up 0.1%, and WTI crude fell 1.6%, dipping below $70 a barrel amid OPEC+ headlines.

At the sector level XLU and XLP were leaders with XLE the biggest decliner followed by XLC and XLB respectively. With Yields on the 2yr and 10yr both below 3.8% bond proxy sectors have been ascendant.

Tuesday’s selloff lacked a clear catalyst but was attributed to softer macroeconomic data, systematic unwinds, yen strength, and post-earnings pressure on NVDA. The focus is now on growth concerns after softer JOLTS job openings and cautious Beige Book takeaways. However, job openings remain high, and there is some optimism for a potential Fed rate cut.

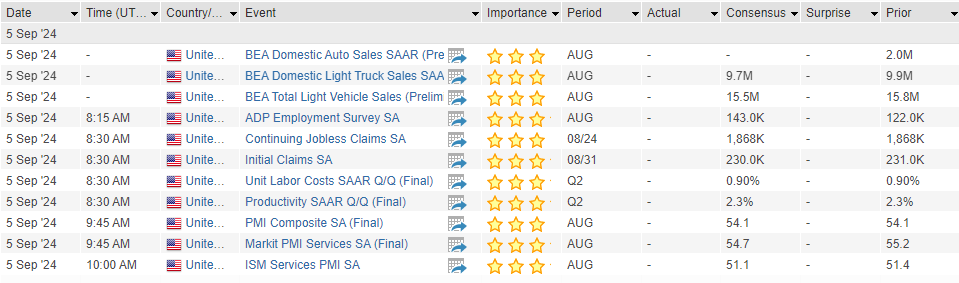

Upcoming economic reports include ADP payrolls, initial claims, and ISM services on Thursday, with the August employment report on Friday. Nonfarm payrolls are expected to rise by around 165K, with a slight drop in the unemployment rate to 4.2%.

Key stock movements included gains for Frontier Communications (+38%) on acquisition talks, Gitlab (+21.6%) on strong earnings, and Saia Inc (+9.7%) on positive shipment trends. Notable decliners were Dollar Tree (-22.2%) due to missed earnings and lowered guidance, Zscaler (-18.7%) on mixed results and guidance, and US Steel (-17.5%) on acquisition block news.

Overall, the market remains focused on growth concerns, upcoming economic data, and potential Fed actions.

The July JOLTS report showed a drop in job openings to 7.673 million, below the consensus of 8.1 million, and marked the lowest level since January 2021. June’s figure was also revised down by 274,000 to 7.91 million. Healthcare, social assistance, and state/local government had the biggest decreases in job openings, while business services and the federal government saw increases. The rates of hires and separations were relatively unchanged at 3.5% and 3.4%, respectively. The JOLTS miss follows the ISM manufacturing report, which indicated growth concerns due to a decline in new orders despite a rise in the employment component.

Looking ahead, key employment data such as the ADP report, jobless claims, and ISM services index will be released tomorrow, with the August nonfarm payrolls report expected on Friday, projecting an increase of 165,000 jobs and a slight dip in the unemployment rate to 4.2%. July factory orders rose 5.0% month-over-month, above expectations.

The Fed’s August Beige Book reported that nine districts experienced flat or declining economic activity, up from five previously, while three districts saw slight growth. Overall, employment was steady with minimal layoffs, modest wage growth, and varying input costs. Consumer spending and manufacturing activity declined in most districts, with some anticipating slight declines in the coming months.

Eco Data Releases | Thursday September 5th, 2024

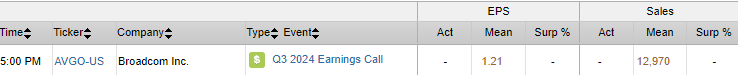

S&P 500 Constituent Earnings Announcements by GICS Sector | Thursday September 5th, 2024

Data sourced from FactSet Data Systems