ETFsector.com Daily Trading Outlook, September 4, 2024

US equities closed sharply lower on Tuesday, with the Dow down 1.51%, the S&P 500 down 2.12%, the Nasdaq down 3.26%, and the Russell 2000 down 3.09%. This marked the worst session for the S&P 500 and Nasdaq since August 5th.

At the sector level, XLK was the source of turmoil posting a loss of 4.59% while commodities linked XLB, XLE and XLI also posted declines > 2%. Unsurprisingly, lower vol. sectors outperformed with XLP, XLRE, XLU and XLV leading in descending order.

Big tech stocks, including NVDA, were significant decliners, contributing to a broader sell-off in semiconductors, with the SOX index having its worst day since March 2020. Other sectors under pressure included energy, industrial metals, chemicals, machinery, building products, auto suppliers, aerospace, and small caps.

Relative outperformers included managed care, P&C insurance, airlines, payments, department stores, telecom, multifamily REITs, food and beverage, and HPCs. Treasuries gained with a flatter curve, while the 2/10 spread became more inverted. The dollar index edged up 0.1%, and the yen strengthened on Bank of Japan tightening expectations. Gold fell 0.2%, copper dropped 2.9%, and WTI crude fell 4.3% amid concerns about China’s demand and OPEC+ production adjustments.

The risk-off sentiment came as global growth fears persisted, compounded by a weak ISM manufacturing report showing contraction for the fifth consecutive month. This data supported expectations for a 50-basis point Fed rate cut in September. Investors await the August payrolls report, which could influence the Fed’s near-term policy.

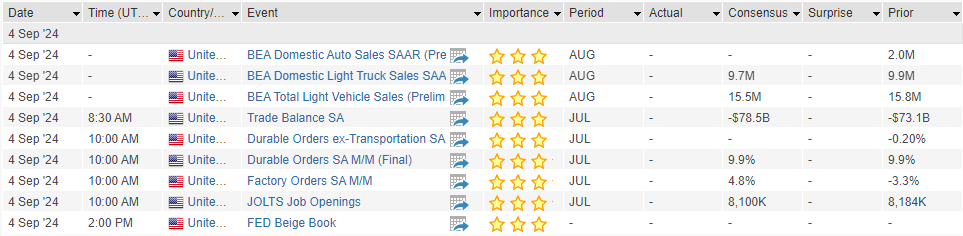

Wednesday’s calendars feature JOLTS data along with Factory and Durable Goods orders posting. On the earnings side, DLTR, HRL, HPE and CPRT report.

Notable gainers included PCVX (+36.4%) on positive vaccine trial results, SHLS (+15.6%) on a favorable legal ruling, and PSNY (+12.3%) on a new CFO appointment. Notable decliners included DYN (-30.7%) following adverse trial data, INTC (-8.8%) on restructuring news, and BA (-7.3%) following a downgrade.

Eco Data Releases | Wednesday September 4th, 2024

S&P 500 Constituent Earnings Announcements by GICS Sector | Wednesday September 4th, 2024

Data sourced from FactSet Data Systems