S&P futures are down 0.3% in Thursday morning trading, following a mixed close for US equities on Wednesday. Semiconductors and China tech outperformed, while apparel, retail, autos, builders, and food/beverage lagged. TSLA-US led declines among the Mag 7 stocks. Treasuries weakened, and the dollar index rose 0.2%, with sterling under pressure due to dovish BoE comments. WTI crude rose 2.3%, while gold dipped 0.2% and Bitcoin futures were up 0.1%.

Markets remain focused on Friday’s September NFP report as the debate continues over a 25 vs. 50 bp rate cut in November. Geopolitical concerns linger, particularly around the Middle East, as markets await Israel’s response to Iran’s missile strike. Central bank dovishness has done little to boost sentiment, and excitement over China’s stimulus has cooled, especially with Hong Kong’s pullback. Concerns about stretched positioning, elevated valuations, and negative seasonality persist.

On the economic calendar today: initial jobless claims, August factory orders, and September ISM services. STZ-US reports earnings before the open. NVDA-US CEO highlighted strong demand for Blackwell chips and an expanded AI partnership with ACN-US. LEVI-US fell after missing Q3 revenue, trimming its Q4 outlook, though DTC strength and GM expansion were noted as positives. HIMS-US dropped after the FDA removed LLY-US‘s weight-loss drug from the shortage list.

US equities close slightly higher Wednesday:

US equities finished Wednesday with modest gains, as the Dow rose +0.09%, the S&P 500 edged up +0.01%, and the Nasdaq gained +0.08%. The Russell 2000 dipped slightly by -0.09%. While markets ended near their highs, they oscillated around the unchanged mark for much of the afternoon. Outperformers included semiconductors, China tech, asset managers, and ag chemicals, while laggards included apparel, autos, retail, pharma/biotech, and homebuilders. Treasuries weakened, with some curve steepening after strength on Tuesday. The Dollar Index gained 0.4%, driven by yen weakness amid dovish Bank of Japan comments. Gold declined 0.8%, and Bitcoin futures fell 2.7%, while WTI crude settled up 0.4%. Markets showed resilience despite ongoing Middle East tensions and the work stoppage at US East/Gulf Coast ports. Investors are also focused on the broader labor market data, which continues to shape the debate on the Fed’s next rate move.

Technology (XLK) and Consumer Discretionary (XLY) gained, with XLK rising 0.3% on strength in semiconductors, driven by stocks like NVIDIA. Communication Services (XLC) was boosted by China tech stocks, gaining 0.4%. Financials (XLF) also saw a lift, up 0.2%, supported by asset managers’ solid performance. However, Industrials (XLI) edged down 0.1%, with machinery and autos under pressure despite gains in casinos and logistics. Healthcare (XLV) lagged, down 0.5%, weighed by Humana’s steep drop after a negative star rating announcement. Energy (XLE) outperformed, up 0.6%, as oil prices rose amid Middle East tensions. Utilities (XLU) and Real Estate (XLRE) were relatively flat, both down less than 0.1%. Consumer Staples (XLP) fell 0.3%, with Conagra’s earnings miss dragging the sector. Materials (XLB) gained 0.2%, driven by strength in agricultural chemicals. Consumer Discretionary (XLY) was mixed, with Nike down 6.8% following weaker-than-expected guidance.

Wednesday’s stock level highlights:

Information Technology

- CIEN-US (+7.4%): Ciena Corporation gained after announcing a $1B share repurchase authorization.

Consumer Discretionary

- TSLA-US (-3.5%): Tesla’s Q3 deliveries fell short of expectations, with 462,890 deliveries versus a consensus of over 483K. Deliveries for the Model 3 and Y were ahead of estimates, but other models, including the S and X, came in below consensus at ~23K compared to the expected 28K.

- NKE-US (-6.8%): Nike’s fiscal Q1 sales were weaker than expected, though gross margins and SG&A performance drove an EPS beat. The company provided soft Q2 guidance and withdrew its FY25 forecast due to CEO transition and a challenging macro environment. Headwinds include industry slowdown, softer BTS (Back to School) trends, weaker China performance, and lighter spring order books.

- PVH-US (-2.8%): Downgraded to neutral from buy at Bank of America, PVH faces sales growth challenges, with European spring orders down and revised US and China sales expectations. The company also flagged lower-than-expected SG&A savings.

- HOG-US (-4.1%): Harley-Davidson was downgraded to neutral from outperform at Baird due to significant retail declines and rising inventory concerns, with sales reportedly down double-digits in certain segments.

Health Care

- HUM-US (-11.8%): Humana fell sharply after preliminary Star ratings showed ~25% of its members (around 1.6M) are currently enrolled in plans rated 4 and above for 2025, down from 94% in 2024.

- CVS-US (+1.1%): Glenview Capital clarified that it is not pushing for a split of CVS’s retail and insurance units, contrary to recent media reports. Analysts remained mixed on the prospect, but CVS may face challenges in meeting financial targets, with or without a breakup.

Consumer Staples

- CAG-US (-8.1%): Conagra’s fiscal Q1 earnings and revenue missed expectations, with weaknesses in the Refrigerated/Frozen and Foodservice segments. Organic growth was weaker than anticipated, and management flagged pressures from strategic investments and lower volumes.

Communication Services

- SPHR-US (+7.3%): Sphere Entertainment was upgraded to outperform from peer perform at Wolfe Research, which cited high return on investment for new Sphere venues and profitability in live entertainment compared to traditional arenas.

Industrials

- JOBY-US (+27.9%): Joby Aviation surged after announcing that Toyota would invest an additional $500M to support the certification and commercial production of its electric air taxi.

Materials

- RPM-US (+6.3%): RPM International reported better-than-expected FQ1 earnings, although revenue was lighter across all segments. The company expressed optimism that lower interest rates might spark a rebound in the residential end markets.

Consumer Discretionary (Casinos & Hotels)

- CZR-US (+5.3%): Caesars Entertainment repurchased 3.87M shares at $36.38 per share in Q3, completing its 2018 buyback program. The company authorized a new $500M buyback and announced that proceeds from the WSOP intellectual property sale would be used to pay down debt or reinvest in the business.

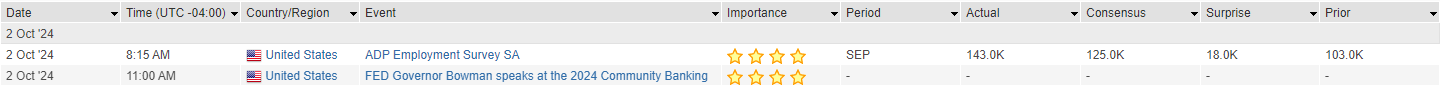

Eco Data Releases | Thursday October 3rd, 2024

S&P 500 Constituent Earnings Announcements | Thursday October 3rd, 2024

Data sourced from FactSet Data Systems