S&P futures rose 0.2% on Thursday morning following Wednesday’s rally, where the S&P 500 gained over 2.5%—its best post-election performance on record—and marked its 48th all-time high of 2024. Small caps led gains, with banks, deregulation beneficiaries, crypto, and select big tech also performing well. Treasuries were mixed, with a steepening curve after Wednesday’s yield rise. The dollar index fell 0.2%, gold was down 0.2%, Bitcoin futures dropped 2%, and WTI crude declined 1.3%.

Market sentiment remains focused on post-election dynamics, with momentum driven by the unwinding of election hedges, favorable seasonality, buybacks, and anticipation of Q4 earnings growth and Fed policy normalization. A Trump victory and potential GOP sweep are seen as positives for deregulation and tax cuts, though concerns linger over global trade disruption, increased tariffs, and fiscal policies that could impact the Fed’s easing cycle and trigger higher bond yields.

On the economic calendar, Q3 nonfarm productivity, labor costs, and initial jobless claims are set for release. The Fed is expected to announce a 25-basis-point rate cut, with Powell emphasizing a data-dependent approach for future policy decisions. Overseas, China reported its fastest export growth in over two years, the Bank of England cut rates by 25 basis points as expected, while the Riksbank cut by 50 basis points and Norges Bank held steady.

Earnings highlights include QCOM beating and raising guidance on IoT/Auto strength, ARM beating without a guidance raise, GILD surpassing estimates with strong HIUV performance, and MCK raising guidance on robust U.S. Pharma results. APP rose sharply on an earnings beat and improved guidance, while KVUE missed expectations and guided lower. HSY missed earnings and cut its revenue forecast, MTCH posted light revenue with underperformance at Tinder, and DUOL had positive takeaways despite valuation concerns. ZG saw gains from share growth and product momentum.

U.S. equities surged on Wednesday, with the Dow rising 3.57%, the S&P 500 up 2.53%, the Nasdaq climbing 2.95%, and the Russell 2000 gaining 5.84%. Stocks closed near their highs, setting new record levels for major indexes. The rally built on Tuesday’s gains and was fueled by optimism over Trump’s potential return to the White House and the possibility of a “Red Sweep” in Congress, which alleviated election-related uncertainties. Leading sectors included small caps, banks, construction materials, media, energy equipment, machinery, and transports, with TSLA standing out among big tech. Underperformers included solar, copper, China tech, hospitals, homebuilders, exchanges, precious metals miners, and defensive sectors.

Treasuries came under pressure, with the 10-year yield rising over 80 basis points since mid-September, steepening the curve. The dollar index posted its best session since September 2022, up 1.6%. Gold fell 2.7%, Bitcoin futures surged 9.4%, WTI crude dipped 0.4% but recovered from worse levels, and copper fell 4.9%.

There were no major U.S. economic reports on Wednesday, but the $25 billion auction of 30-year Treasury bonds was well received, following a strong 10-year note auction on Tuesday. On Thursday, the focus shifts to Q3 nonfarm productivity, labor costs, and initial jobless claims, along with the FOMC announcement. The Fed is expected to announce a 25 basis-point rate cut, with Powell emphasizing data dependency in future policies. Fiscal and trade policies are not expected to be discussed. The week concludes with the University of Michigan’s preliminary consumer sentiment and inflation expectations on Friday, and a speech by Fed Governor Bowman.

GICS Sector Summary:

- Information Technology

- Qualys (QLYS): Up 24.2% after a strong Q3 beat, raised FY24 guidance, and news of exploring a potential sale due to takeover interest.

- Super Micro Computer (SMCI): Down 18.1% after preliminary Q3 revenue missed expectations and weak December quarter guidance, despite no signs of misconduct.

- Microchip Technology (MCHP): Provided lower guidance citing inventory corrections and weak seasonality.

- Health Care

- Masimo (MASI): Gained 10.6% on strong Q3 results and raised FY24 EPS outlook, despite a lower revenue forecast.

- CVS Health (CVS): Rose 11.3% after reporting a revenue beat and strong pharmacy sales growth.

- Exact Sciences (EXAS): Fell 23.5% after a Q3 revenue and margin miss, citing weaker commercial execution and hurricane disruptions; FY guidance was cut.

- Lantheus Holdings (LNTH): Declined 20.7% despite good Q3 results; analysts noted slower sequential growth.

- Industrials

- Trimble (TRMB): Increased 17.9% after surpassing Q3 revenue and EPS expectations, raising FY guidance, and noting record ARR growth.

- Howmet Aerospace (HWM): Up 12.4% after Q3 beats and positive Q4 guidance, though trends for early 2024 were noted as cautious.

- Brink’s (BCO): Fell 1.2% after missing Q3 earnings and cutting FY24 guidance due to currency impacts and market headwinds.

- Consumer Discretionary

- Six Flags Entertainment (FUN): Rose 7.3% after a revenue beat in Q3, citing strong October demand and 2025 season pass sales.

- iRobot (IRBT): Dropped 35.2% after announcing a 16% reduction in workforce and CFO retirement.

- Coupang (CPNG): Fell 10.8% despite Q3 beats on EPS and revenue; margins and FCF were flagged as concerns.

- Celsius Holdings (CELH): Declined 5.3% following a Q3 miss, citing reduced margins due to supply chain adjustments by PepsiCo.

- Energy

- Northern Oil & Gas (NOG): Increased 11.7% on a Q3 EPS beat and reaffirmed production guidance.

- Materials

- Owens Corning (OC): Q3 sales were in line, but strong margins led to EBIT exceeding expectations.

- Charles River Laboratories (CRL): Up 13.5% on a strong Q3 and raised FY24 guidance, noting stable demand.

- Communication Services

- Teledyne Technologies (TDY): Gained 4.7% after announcing a $710 million acquisition of select aerospace and defense electronics assets, expected to close in early 2025.

- Financials

- ODP Corp. (ODP): Dropped 11.4% after a significant Q3 EBITDA miss and reduced guidance, citing macroeconomic and competitive pressures

Eco Data Releases | Thursday November 7th, 2024

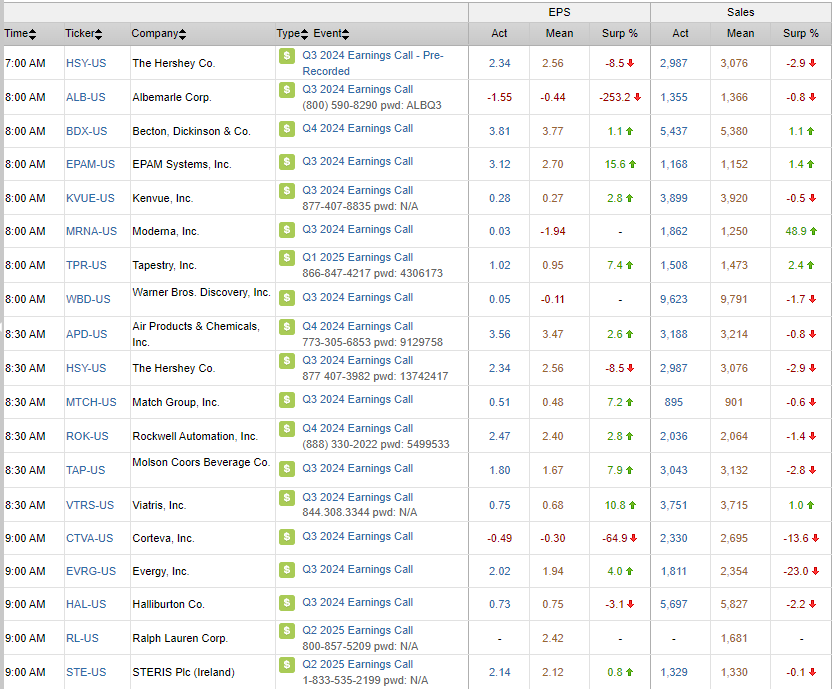

S&P 500 Constituent Earnings Announcements | Thursday November 7th, 2024

Data sourced from FactSet Research Systems Inc.