Equities were positive on the day with Discretionary stocks leading the tape. FDX posted a strong beat and price targets were raised at BofA and other sell side shops on optimism about its freight business. The S&P 500 finished up 0.16% while the Dow edged higher by 0.04%. The Nasdaq composite was the leader on the day with components TSLA and AMZN delivering strong performance.

After hours Micron earnings beat initial estimates, but the stock sold off in the after-hours session. The Philadelphia Semiconductor Index (SOX) was off 1.00% in the session.

The US 10yr Treasury Yield added 5 bps to close at 4.32%, while Crude and commodities prices finished weaker. The Bloomberg Commodities Index price fell below its 200-day moving average for the first time since early May.

A busy economic calendar for Thursday with Initial and continuing jobless claims, durable goods orders and pending home sales highlighting the releases.

Eco Data Releases | Thursday June 27th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 06/27/2024 08:30 | GDP Annualized QoQ | 1Q T | 1.40% | — | 1.30% | — |

| 06/27/2024 08:30 | Personal Consumption | 1Q T | 2.00% | — | 2.00% | — |

| 06/27/2024 08:30 | GDP Price Index | 1Q T | 3.00% | — | 3.00% | — |

| 06/27/2024 08:30 | Core PCE Price Index QoQ | 1Q T | 3.60% | — | 3.60% | — |

| 06/27/2024 08:30 | Advance Goods Trade Balance | May | -$96.0b | — | -$99.4b | -$98.0b |

| 06/27/2024 08:30 | Wholesale Inventories MoM | May P | 0.10% | — | 0.10% | — |

| 06/27/2024 08:30 | Retail Inventories MoM | May | 0.30% | — | 0.70% | — |

| 06/27/2024 08:30 | Initial Jobless Claims | 22-Jun | 235k | — | 238k | — |

| 06/27/2024 08:30 | Continuing Claims | 15-Jun | 1828k | — | 1828k | — |

| 06/27/2024 08:30 | Durable Goods Orders | May P | -0.50% | — | 0.60% | — |

| 06/27/2024 08:30 | Durables Ex Transportation | May P | 0.20% | — | 0.40% | — |

| 06/27/2024 08:30 | Cap Goods Orders Nondef Ex Air | May P | 0.10% | — | 0.20% | — |

| 06/27/2024 08:30 | Cap Goods Ship Nondef Ex Air | May P | 0.20% | — | 0.40% | — |

| 06/27/2024 10:00 | Pending Home Sales MoM | May | 0.50% | — | -7.70% | — |

| 06/27/2024 10:00 | Pending Home Sales NSA YoY | May | -4.60% | — | -0.80% | — |

| 06/27/2024 11:00 | Kansas City Fed Manf. Activity | Jun | -5 | — | -2 | — |

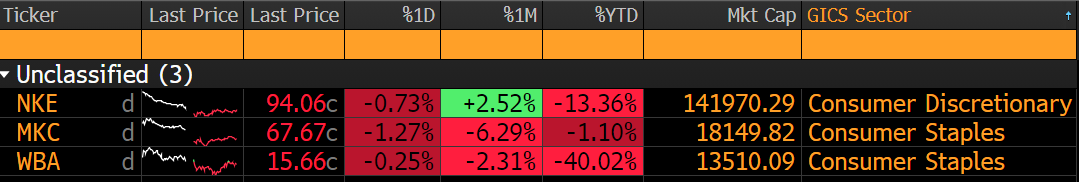

S&P 500 Constituent Earnings Announcements by GICS Sector | Thursday June 27th, 2024

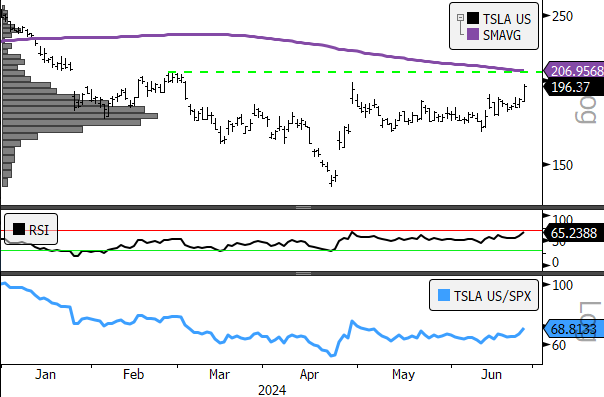

NKE reports on Thursday and looks to keep some near-term momentum alive for the XLY. The sector has bucked poor technical and fundamental trends to outperform this month, but the rally has yet to break-out above significant overhead resistance. Near-term strength in TSLA and AMZN have contributed to the turn around. AMZN is on solid technical footing while TSLA, like the sector in aggregate, needs to show a little more to get us interested.

- XLY (200-day m.a. | Relative to S&P 500)

- $185 is a kye level to watch for a material upside break-out

- TSLA (200-day m.a. | Relative to S&P 500)

- Price moving above the 200-day at $206 would project an intermediate-term price target of above $260

Sources: Bloomberg