The Dow expanded upon its all-time high on Wednesday adding 0.59% while selling in the Nasdaq Composite continued with the Tech. heavy Index off -2.77%. The broad market S&P 500 was down -1.39% as laggard Sectors led the tape. XLP led, up 1.29%, while XLE added 1.00%. XLK was a big drag on the S&P 500 giving up 3.89% in the Sector’s biggest 1-day decline of the year.

Economic releases are highlighted by Initial Jobless Claims and Continuing Claims. The earnings calendar remains in full swing with NFLX looking to stanch recent selling by posting strong results. DHI, MMC, BX, ISRG and TXT are other big names reporting on Thursday.

Outside of the Large Cap. US space, the RTY and RMC indices halted rallies in small and mid-cap. stocks respectively. Yields rose marginally on the US 10yr and 2yr and Crude climbed 0.35% to finish at $83.14 while the Bloomberg Commodities Index finished off 0.38%.

The catalyst for the sharp Tech. Sector sell-off was attribute to weak ASML earnings affecting the Semiconductor space broadly as Asian chip stocks sold off on the news.

Eco Data Releases | Thursday July 18th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | ||

| 07/18/2024 08:30 | Initial Jobless Claims | 13-Jul | 229k | — | 222k | — | |

| 07/18/2024 08:30 | Continuing Claims | 6-Jul | 1856k | — | 1852k | — | |

| 07/18/2024 08:30 | Philadelphia Fed Business Outlook | Jul | 2.9 | — | 1.3 | — | |

| 07/18/2024 10:00 | Leading Index | Jun | -0.30% | — | -0.50% | — | |

| 07/18/2024 16:00 | Total Net TIC Flows | May | — | — | $66.2b | — | |

| 07/18/2024 16:00 | Net Long-term TIC Flows | May | — | — | $123.1b | — | |

S&P 500 Constituent Earnings Announcements by GICS Sector | Thursday July 18th, 2024

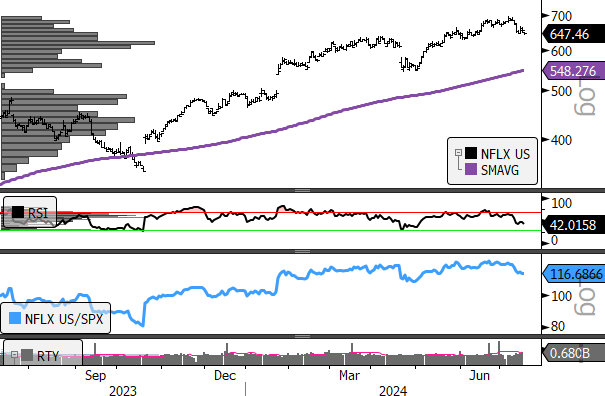

NFLX is likely the most consequential name to report on Thursday. The stock (chart below) is oversold near-term in the context of a longer-term uptrend. Momentum has shown a negative divergence and near-term weakness in META and GOOG/L does not bode well for the stock. Aa test of the 200-day moving average is likely.

- NFLX 1yr, daily

- Panel 2: RSI: Negative divergence forming since January of 2024

- Panel 3: Relative Strength: A move below April lows would be concerning technically

Sources: Bloomberg