S&P futures up 0.4% Thursday morning after US equities closed lower Wednesday, led by big tech weakness, particularly NVDA. Asian markets were mixed in quiet trading with several markets still closed for LNY. European markets up ~0.6%. Treasuries firmer, with 10Y yields approaching 4.50%. Dollar little changed, with yen strength notable. Gold up 0.8%. Bitcoin futures up 1.5%. WTI crude down 0.7%.

Key Market Themes

Earnings dominate headlines, with META and TSLA leading tech, while MSFT lagged on a lack of Azure acceleration commentary. AI sentiment broadly positive following the DeepSeek shakeout. Fed in focus, with markets still expecting no rate cut until June. Trump 2.0 policy remains a source of headline volatility, particularly on tariffs.

Macro Focus

US Q4 GDP expected at +2.7%, driven by strong consumer spending. Initial claims forecast at 224K. ECB decision expected to cut rates for the fourth straight meeting to 2.75%. Washington sees more confirmation hearings, including RFK Jr. and Gabbard. Friday brings core PCE inflation, ECI, and Chicago PMI

Earnings Highlights

- MSFT (-): Lower as Azure acceleration guidance was absent.

- META (+): AI tailwind a key focus.

- TSLA (+): EPS miss, but FCF ahead; reiterated key milestones, upbeat FSD commentary.

- CAT (-): Sales, margins, and guidance all light.

- UPS (-): Weak guidance, plans to reduce AMZN volume.

- NOW (-): Beat but underwhelmed; guidance soft.

- CI (-): Hit by higher costs.

- IBM (+): Strong software growth and FCF guidance.

- LRCX (+): Beat and guided well above consensus.

- URI (-): Q4 in line but soft 2025 EBITDA and FCF guidance.

- LVS (-): Missed, but Singapore a bright spot.

- WDC (-): Focus on upcoming spin-off.

- CHRW (-): Freight recession ongoing.

- LEVI (-): Beat with positive outlook, but FY25 guidance soft.

- WHR (-): 2025 guidance weak, no signs of consistent recovery.

US Equities Lower Wednesday: Dow (-0.31%), S&P 500 (-0.47%), Nasdaq (-0.51%), Russell 2000 (-0.25%)

US equities closed lower on Wednesday, though off worst levels. The S&P and Nasdaq remain down for the week, while equal-weight S&P outperformed after lagging on Tuesday. Big tech was mostly lower, with NVDA the biggest Mag 7 decliner amid renewed China export restriction concerns. Other laggards included software, life sciences, hospitals, exchanges, containerboard, EVs, A&D, and homebuilders. Outperformers included restaurants, airlines, banks, life insurers, machinery, apparel, drug stores, industrial metals, and ag chemicals. Treasuries weakened with curve flattening. The dollar index gained 0.1%. Gold edged up 0.1%. Bitcoin futures climbed 3.3%. WTI crude fell 1.6%.

Key Market Themes

The FOMC decision was largely as expected, with the Fed holding rates steady. However, takeaways skewed hawkish due to firmer labor market language and inflation still “somewhat elevated.” Powell indicated no rush to cut rates, though he acknowledged rates are “meaningfully less restrictive” than when cuts began. Market expectations remain for a mid-year rate cut. AI remained in focus as reports surfaced that the White House is considering restricting NVDA’s H20 chip sales to China. Trump 2.0 policy uncertainty persisted, with reports of a retreat from the federal grant freeze while Commerce Secretary nominee Lutnick signaled broad tariff support.

Earnings Highlights by GICS Sector

Information Technology

- ASML (+4.3%): Strong Q4 orders; AI demand driving growth but some 2026 uncertainty flagged.

- FFIV (+11.4%): Beat on earnings, revenue, and margins; billings and deferred revenue ahead of consensus; raised FY EPS/revenue guidance.

- QRVO (+4.3%): Beat expectations but faced scrutiny on transition and margin outlook.

- DDOG (-4.1%): Downgraded to hold at Stifel, citing full valuation and revenue headwinds from AI usage optimization.

Consumer Discretionary

- SBUX (+8.1%): Q1 revenue and EPS beat; comp decline better than expected, with management optimistic on turnaround initiatives.

- EAT (+16.3%): Big Q2 beat; Chili’s traffic up on ad investments; raised FY25 EPS guidance by 45%.

- VSCO (-4.6%): Announced CFO transition; raised Q4 guidance after strong holiday sales.

Communication Services

- TMUS (+6.3%): Beat on EPS, EBITDA, and revenue; strong wireless and broadband net adds; FY25 EBITDA midpoint in line.

- DJT (+6.8%): Announced expansion into financial services with Truth.Fi fintech brand.

Industrials

- NXT (+24.3%): Beat on Q3 EPS and revenue; raised FY guidance amid record bookings.

- LII (-8.8%): Q4 earnings and revenue beat, but FY25 EPS guidance midpoint below consensus.

- NSC (+1.8%): Q4 EPS beat, OR improvement guidance; expects to initiate buybacks in Q1.

- GD (-4.2%): Q4 beat as Combat and Marine offset Aerospace softness; Gulfstream deliveries missed expectations.

Financials

- BHF (+14.8%): Reportedly exploring sale; potential split of assets to private equity firms.

- HSIC (+4.9%): KKR took a 12% stake with the ability to increase; announced buyback boost and new board members.

- LC (-14.3%): Q4 EPS missed; originations guidance disappointed; higher expenses weighed on FY25 outlook.

Healthcare

- TEVA (-13.9%): Q4 earnings in line, revenue ahead, but margins missed; FY25 EPS guide below Street.

- MRNA (-9.4%): Downgraded to neutral at Goldman Sachs on concerns over revenue visibility and cash management.

- DHR (-9.7%): Q4 earnings light; revenue better but Q1 core revenue guide lower than expected.

Consumer Staples

- PKG (-9.8%): Q4 EBITDA miss; guided below consensus, citing higher costs and fewer shipping days.

Energy

- RNR (-8.6%): Q4 EPS beat but impacted by non-core items; flagged high casualty loss ratio and hurricane-related losses.

Automobiles & Components

- TSLA (+5%): Profit underwhelmed but flagged vehicle sales rebound.

- GM (-8.9%): Q4 EPS and revenue beat; guided FY25 ahead but analysts cautious on tariff impact.

- RIVN (-2.3%): Initiated at underperform by Bernstein on concerns over competition and market growth limits.

Other Notable Developments

- ULCC (+5.3%): Confirmed confidential discussions with Spirit for a possible merger.

- MANH (-24.5%): Q4 beat but cut FY25 revenue guidance; flagged budget cuts among customers.

- LNY Tech Developments: Alibaba claimed its AI model outperforms DeepSeek, escalating the China-US AI race. Meanwhile, Trump officials reportedly discussing tighter chip export restrictions on NVDA following DeepSeek revelations.

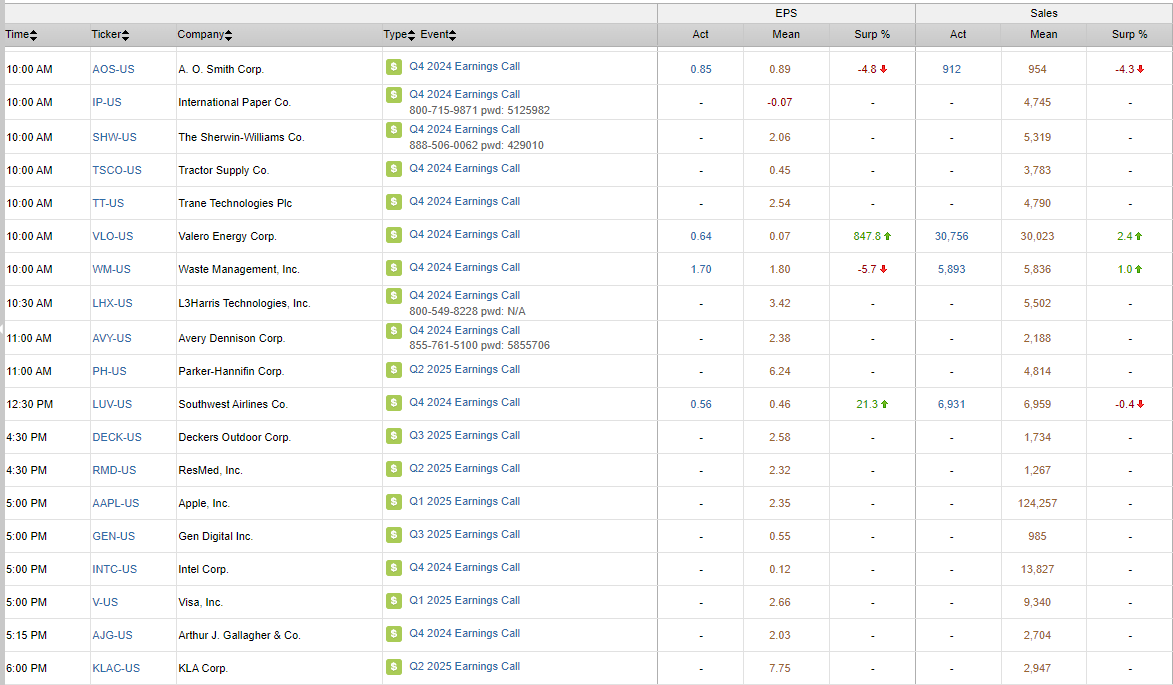

Eco Data Releases | Thursday January 30, 2025

S&P 500 Constituent Earnings Announcements | Thursday January 30, 2025

Data sourced from FactSet Research Systems Inc.