S&P futures are little changed Friday morning following a mixed Thursday session dominated by stock-specific moves. Big tech, banks, GSEs, staples, travel, and E&Cs outperformed, while semis, healthcare, homebuilders, and energy lagged. Asian markets were mixed, with Greater China leading while Japan underperformed. European markets also showed mixed performance. Treasuries were narrowly mixed with curve flattening. The dollar index was steady, gold gained 0.5%, Bitcoin futures rose 0.8%, and WTI crude climbed 0.8%.

Market remains quiet ahead of the January nonfarm payrolls report and February Michigan consumer sentiment data. Payrolls are expected to rise ~170K after December’s 256K gain, with risks skewed to the upside despite weather-related headwinds. Benchmark revisions will also be closely watched. The unemployment rate is forecast to remain at 4.1%, with average hourly earnings rising 0.3% m/m.

Earnings continue to be mixed. AMZN-US posted a solid Q4 but offered light guidance, citing FX headwinds. PINS-US rose on strong guidance, while EXPE-US surged on an earnings beat and accelerating room growth. FTNT-US gained on billings strength and margin expansion. MPWR-US beat estimates, guided above, and announced a $500M buyback. MCHP-US cut guidance due to excess inventory and weak demand. TTWO-US reaffirmed plans for GTA VI’s fall release. DOCS-US soared on a beat-and-raise, while BILL-US disappointed on take rates. SYNA-US guided above expectations, SKX-US missed and guided lower, and ELF-US lowered its outlook. BYD-US saw an EBITDA beat, AFRM-US exceeded GMV expectations, and WERN-US incurred a one-time insurance claim expense. ILMN-US offered no new updates on China-related concerns.

Markets continue to digest trade policy uncertainty, with no major tariff developments. House Republicans made progress on a reconciliation bill, though tax policy remains uncertain. Fed’s Logan signaled skepticism over the need for further rate cuts.

US equities finished mixed on Thursday in a relatively calm trading session. The S&P 500 ended near its best levels after trading in a narrow range. Big tech stocks were mostly higher, with NVDA-US continuing its recent gains, while TSLA-US declined again. Other outperformers included banks, GSEs, exchanges (ICE-US), tobacco (PM-US), China tech, and travel/tourism (HLT-US). Laggards included managed care, hospitals, MedTech, life insurance (MET-US, AFL-US), semis (ARM-US, QCOM-US), homebuilders, energy, HPCs, and ag chemicals. Treasuries were unchanged to weaker at the long end of the curve following a big bull flattening move earlier in the week. The dollar index rose 0.1%, gold declined 0.6%, Bitcoin futures fell 0.2%, and WTI crude settled down 0.6%.

Macro headlines remained relatively uneventful. There were no significant updates on tariffs, and markets are still waiting for clarity on a potential Trump-Xi call. Focus is increasing on the challenges facing Trump’s domestic policy execution. Treasury Secretary Bessent reiterated focus on the 10-year yield, stated opposition to DOGE altering Treasury operations, and supported China tariffs and permanent tax cuts. Economic data showed initial and continuing jobless claims slightly higher than expected, while preliminary Q4 productivity exceeded forecasts but unit labor costs were lower. The Bank of England cut rates by 25 bps as expected but also downgraded 2025 growth projections and raised its inflation forecast. Looking ahead, nonfarm payrolls and Michigan consumer sentiment data will be released Friday. Payrolls are forecast to increase by ~170K in January following December’s 256K surge, with unemployment remaining at 4.1% and average hourly earnings rising 0.3% m/m.

Earnings season remains in full swing, with nearly 60% of S&P 500 companies having reported. The blended growth rate now stands at +15.5%, improving over 200 bps from last week and 350 bps since the quarter began. Beat rates remain strong, with 78% of companies surpassing EPS estimates and earnings surprising to the upside by 6.8%. Notable disappointments in tech (ARM-US, QCOM-US) did not significantly shift sentiment. SWKS-US declined sharply on an iPhone content shift, while RBLX-US dropped after missing DAU and bookings targets. Consumer and retail earnings were well received, with RL-US, TPR-US, and PTON-US among the standouts. Staples were also strong, led by PM-US and HSY-US, despite cocoa price pressures. Autos continued to struggle, with F-US issuing weak guidance. In healthcare, LLY-US was in line with prior forecasts, MOH-US fell on rising costs, and ALGN-US flagged FX headwinds despite analyst optimism. Both HON-US and BDX-US declined after announcing spinoffs.

Asian markets were mixed on Friday, with the Nikkei down 0.62%, ASX 200 up 0.04%, and Kospi down 0.20%. Japan declined further while Korea and Australia saw little change. S&P 500 futures were flat, weighed by AMZN-US after its guidance disappointed. JGB yields moved higher, while Treasuries remained stable ahead of the US nonfarm payrolls report. The yen continued strengthening against the dollar, reaching its highest level since mid-December. Crude oil was flat, and gold held just above overnight lows. Bitcoin remained below $100K. In Asia, the RBI is expected to begin an easing cycle with a 25 bps rate cut, and Japanese household spending exceeded expectations.

Sector and Company News

Information Technology

- Coherent (COHR-US): Surged 11.5% after strong fiscal Q2 results and an upbeat Q3 forecast, with growth in Datacom and Telecom.

- Skyworks (SWKS-US): Plummeted 24.7% due to an iPhone content loss, weaker Q2 guidance, and CEO transition.

- Qualcomm (QCOM-US): Declined 3.7% despite strong Q1 results and Q2 guidance; concerns over tariffs and an expired Huawei license weighed.

- Arm Holdings (ARM-US): Dropped 3.3% after reporting a slower-than-expected adoption of its v9 architecture.

- FormFactor (FORM-US): Fell 6.8% on weak Q4 results and downbeat Q1 guidance, citing sluggish PC and smartphone demand.

- Impinj (PI-US): Down 15.2% following Q4 revenue softness and weak Q1 guidance amid geopolitical uncertainty and inventory issues.

Consumer Discretionary

- Peloton (PTON-US): Jumped 12.0% on an earnings beat and raised guidance, driven by cost savings and subscription growth.

- Ralph Lauren (RL-US): Gained 9.7% on strong FQ3 results and positive FY25 revenue and margin guidance.

- Tapestry (TPR-US): Rose 12.0% on better-than-expected FQ2 earnings, highlighting strength at Coach.

- Ford (F-US): Declined 7.5% after issuing FY25 EBIT guidance 11% below consensus, with tariff uncertainties.

Healthcare

- Molina Healthcare (MOH-US): Dropped 10.1% after missing Q4 EPS estimates due to a higher medical loss ratio.

- Bristol Myers Squibb (BMY-US): Fell 3.8% despite solid Q4 results; Opdivo growth concerns weighed.

- Align Technology (ALGN-US): Declined 10.1% on FX headwinds impacting guidance.

Financials

- MetLife (MET-US): Declined on weak guidance.

- Allstate (ALL-US): Gained 4.3% after beating earnings on better underwriting and investment income.

- Intercontinental Exchange (ICE-US): Up 4.3% after a Q1 earnings beat and positive FY25 outlook for FI & Data Services.

Industrials

- Honeywell (HON-US): Dropped 5.6% despite Q4 earnings meeting guidance, with concerns over its three-way corporate split.

- Hillenbrand (HI-US): Declined 7.3% after selling a 51% stake in Milacron and reporting weaker margins in MTS.

- Equifax (EFX-US): Declined 8.4% on weak Q1 and FY25 EPS guidance amid a sharp decline in mortgage credit inquiries.

Consumer Staples

- Philip Morris (PM-US): Rose 11.0% on strong Q4 earnings, driven by robust cigarette pricing and volume/mix improvements.

- Hershey (HSY-US): Gained 4.4% on better-than-expected Q4 earnings and FY25 revenue guidance, despite cocoa price concerns.

Energy & Materials

- Helmerich & Payne (HP-US): Fell 16.5% following weak Q4 EBITDA and a soft 2025 outlook due to international cost pressures.

Eco Data Releases | Friday February 7th, 2025

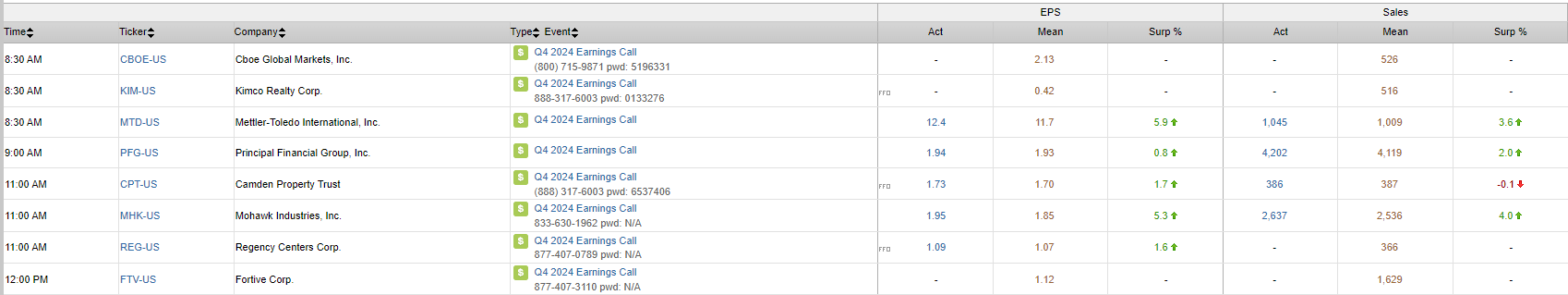

S&P 500 Constituent Earnings Announcements | Friday February 7th, 2025

Data sourced from FactSet Research Systems Inc.