S&P futures up 0.3% Monday morning following Friday’s rally, though last week saw a sharp overall decline. Asian markets mostly higher overnight, with Australia, South Korea, and Japan up over 1%. European markets down ~0.1%. Treasuries slightly weaker, dollar index up 0.3%, gold down 0.2%, Bitcoin futures down 1%, and WTI crude up 0.1%.

Focus remains on holiday sentiment and the potential for a Santa Claus rally, aided by averted government shutdown and thoughts that Wednesday’s hawkish Fed reaction may have been overdone. Systematic and hedge fund selling earlier in the week also highlighted as a factor in last week’s volatility.

Company News

- LLY-US: FDA approved Zepbound for treating sleep apnea in obese adults.

- QCOM-US: Higher after prevailing in key issues in a licensing dispute with ARM-US.

- HMC-US/NSANY-US: Announced plans to merge in 2026.

- NWS-US: Agreed to sell its Foxtel unit to DAZN for $2.1B.

- RUM-US: Surged on securing a $775M investment from Tether

US equities closed higher on Friday, though off intraday peaks. The S&P 500 had its best session since November 6, despite a moderate weekly decline. Big tech mostly rose, with NVDA-US rebounding while TSLA-US failed to sustain a bounce. Outperformers included semis, banks, insurers, homebuilders, autos, hospitals, and REITs, while underperformers included steel, packaging, media, and trucking. Treasuries were mostly firmer, with the curve bear flattening. The dollar index fell 0.7%, while gold gained 1.4%, Bitcoin futures rose 0.3%, and WTI crude ended up 0.1%.

Risk sentiment improved, driven by oversold conditions, softer core PCE inflation data, and declining inflation expectations. Government shutdown concerns eased after House Speaker Johnson indicated an agreement on funding. However, market concerns remain over valuations, a slower Fed easing cycle, bond yield pressures, and geopolitical uncertainty.

In economic data, November core PCE inflation rose 0.1% m/m, below the 0.2% consensus. Personal spending and income growth missed expectations. Final December Michigan consumer sentiment was revised slightly lower but remained at its highest since April. Key Fed speakers expressed mixed views, with NY’s Williams noting rates could move lower and Cleveland’s Hammack suggesting policy is close to neutral.

Company-Specific News

Health Care

- LLY-US (Eli Lilly): Up 1.4% after NVO-US’s weight-loss drug CagriSema underperformed expectations, strengthening LLY’s competitive positioning.

- NVO-US (Novo Nordisk): Down 17.8% after CagriSema demonstrated 22.7% weight loss in a study, below the expected 25%.

- RXST-US (RxSight): Fell 11.9% after Stifel downgraded to hold, citing increased competition and weakening volume expectations for light-adjustable lenses.

Consumer Discretionary

- NKE-US (Nike): Down on weak Q3 guidance and concerns about the longer timeline for its strategic turnaround despite better-than-expected Q2 results.

- CCL-US (Carnival): Beat on earnings, with record 2025 bookings driving positive momentum.

- TRIP-US (TripAdvisor): Increased 7.3% following the announcement of a merger with LTRPA-US, valuing the transaction at $435M.

- WGO-US (Winnebago): Declined 3.8% following a revenue miss and narrowed FY25 guidance; ongoing challenges expected into Q2.

Real Estate

- IIPR-US (Innovative Industrial Properties): Plunged 22.7% after tenant PharmaCann defaulted on December rent for six of eleven leases, raising concerns over revenue sustainability.

Energy

- OXY-US (Occidental Petroleum): Rose 3.9% after Berkshire Hathaway disclosed purchasing 8.9M shares, increasing its stake to 264.3M shares.

Information Technology

- BB-US (BlackBerry): Gained 23.8% after Q3 earnings beat and strong IoT growth; FY guidance was raised.

Financials

- KR-US (Kroger): Up 1.5% after announcing accelerated $5B share repurchase agreements, supplementing its remaining $2.5B capacity.

Industrials

- X-US (United States Steel): Dropped 5% after a Q4 EPS preannouncement highlighted depressed steel prices and cost pressures.

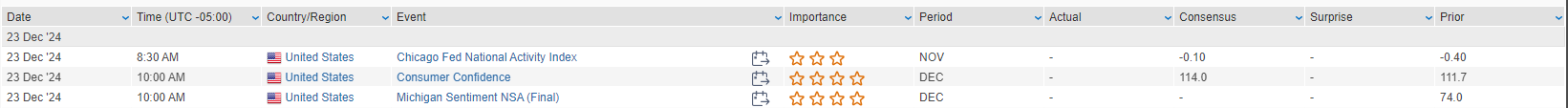

Eco Data Releases | Monday December 23rd, 2024

S&P 500 Constituent Earnings Announcements | Monday December 23rd, 2024

Data sourced from FactSet Research Systems Inc.