S&P futures up 0.1% Monday morning following a mostly lower week for US equities. Small-caps, rate-sensitive sectors, industrial metals, and banks lagged, while big tech outperformed, led by GOOGL-US, though NVDA-US saw pressure. Asian markets mostly lower, with Shenzhen and Hang Seng declining on weak China activity data. South Korea also slipped after early gains from impeachment developments. European markets down ~0.3%. Treasuries firmer after last week’s yield rise. Dollar index down 0.1%. Gold flat. Bitcoin futures up 1.9%. WTI crude down 1.5%.

Markets await Wednesday’s FOMC decision, with a 25 bp rate cut expected, though the Fed may signal a slower easing pace. Seasonal strength and soft-landing optimism remain key themes, though concerns persist about narrowing market breadth and rising yields. Weekend highlights include China’s underwhelming November activity data, South Korea’s presidential impeachment, and Moody’s downgrade of France.

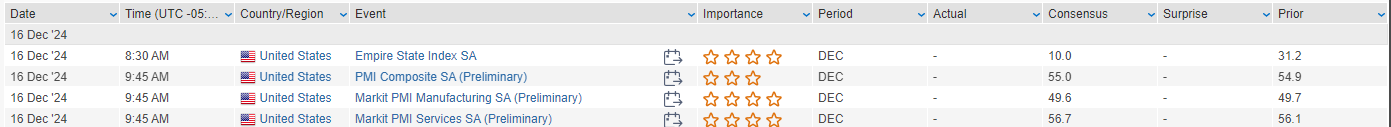

Economic data includes Empire manufacturing and PMIs today, retail sales and industrial production Tuesday, and Wednesday’s FOMC decision and Powell’s press conference. Key earnings this week include LEN-US, MU-US, FDX-US, NKE-US, ACN-US, and CCL-US.

Corporate updates: AAPL-US reportedly planning foldable, thinner iPhones at lower price points. TSLA-US raised Model S prices by $5K. HON-US exploring strategic options for its aerospace business. MSTR-US, PLTR-US, and AXON-US joining the Nasdaq 100. POST-US exploring a merger with LW-US. BHLB-US and BRKL-US in merger talks. CPRI-US may sell Jimmy Choo and Versace brands. SMCI-US down after hiring Evercore to raise capital.

US equities closed mixed on Friday in quiet trading. The S&P 500 ended flat, while the Dow fell 0.20%, and the Nasdaq gained 0.12%. The Russell 2000 underperformed, down 0.60%. The S&P saw its first weekly decline after three consecutive gains, while the Nasdaq extended its weekly winning streak to four weeks, aided by tech strength. Major laggards included small-caps, banks, chemicals, industrial metals, homebuilders, and media, while semiconductors, telecom, apparel, and department stores outperformed. Treasuries weakened with curve steepening. The dollar index was flat, with a stronger euro after French PM announcements and yen weakness tied to expectations of a BoJ hold. Gold dropped 1.2%, Bitcoin futures rose 1.9%, and WTI crude settled up 1.8%.

Seasonality dynamics were noted as the market enters a historically strong period, though the rally’s breadth has been scrutinized with decliners outpacing gainers for ten straight sessions. Sentiment also drew optimism from tech leaders like AVGO and RH, which reported positive guidance despite mixed quarterly results. Import and export price data were in focus, with import prices flat m/m and export prices rising 0.1%, both above consensus expectations. Looking ahead, next week’s macro highlight is Wednesday’s FOMC decision and SEP update, alongside key data on retail sales, housing, and personal income and spending.

Positive sentiment in the market was driven by strong guidance from tech leader Broadcom (AVGO) and luxury retailer Restoration Hardware (RH), despite both companies reporting mixed quarterly results. Market sentiment remains buoyed by favorable seasonality as the year-end rally gains momentum; however, concerns over deteriorating breadth persist, with decliners outpacing gainers for ten consecutive sessions. On the policy front, expectations for a 25 basis point rate cut at next week’s FOMC meeting remain high, while the Bank of Japan and European Central Bank policies continue to draw attention, reflecting global monetary policy dynamics.

Corporate News by GICS Sector

Information Technology

- AVGO-US (+24.4%): Reported in-line Q4 revenue, beat on EPS and margins, and issued strong Q1 guidance. Analysts highlighted new AI ASIC customer wins and management commentary on AI market inflection.

- TASK-US (+15.6%): Upgraded by Morgan Stanley to overweight, citing its valuation as an AI beneficiary and growth opportunities with major clients.

- ZI-US (-2.0%): Downgraded to underweight by KeyBanc, noting demand weakness, declining customer headcount, and heightened competition concerns.

- CIEN-US (+6.2%): Upgraded to buy by Bank of America, citing stabilizing North American demand, easing inventory pressures, and hyperscaler-driven growth potential.

Consumer Discretionary

- RH-US (+17.0%): Despite Q3 sales and EPS misses, the company raised demand and operating margin guidance for Q4 and FY25. Analysts were positive on share gains, demand recovery, and potential housing market stabilization.

- PENN-US (+3.9%): Upgraded by JPMorgan to overweight, citing valuation and growth potential in both interactive and land-based casino segments.

Health Care

- FOLD-US (-7.8%): Downgraded by Morgan Stanley to equal weight on valuation concerns, with a focus on investor anticipation for pipeline updates in 2025 and beyond.

- CNC-US (+2.5%): Upgraded by UBS to buy, citing valuation and improved outlook on Medicaid rate trends and reduced subsidy headwinds in the public-exchange space.

Financials

- PGR-US (+3.7%): Posted strong November results with improved EPS, net premiums, and a lower combined ratio. Analysts highlighted the monthly acceleration in personal auto policies and beat against low expectations.

Staples

- POST-US (-2.2%): Reuters reported the company is exploring a potential merger with LW-US under pressure from activist investor Jana Partners.

- LW-US (+6.8%): Gained on reports of POST-US hiring advisors for a potential acquisition, reflecting growing strategic alternative considerations.

Communication Services

- RBRK-US (-2.7%): CEO reportedly sold 1.12M shares through Goldman Sachs, creating some selling pressure.

Eco Data Releases | Monday December 16th, 2024

S&P 500 Constituent Earnings Announcements | Monday December 16th, 2024

No constituents report today

Data sourced from FactSet Research Systems Inc.