S&P futures are up 0.1% in Wednesday morning trading following Tuesday’s pullback, where big tech provided some cushion amid lagging semis, software, builders, industrial metals, and China tech. Asian markets were mixed, with South Korea and mainland China higher, Japan flat, and Hong Kong underperforming. European markets edged higher. Treasuries weakened, marking a third day of rising yields. Dollar index +0.2%, gold +0.3%, Bitcoin futures +2.2%, WTI crude +1.5%.

Markets await today’s CPI for more clarity ahead of next week’s FOMC decision. A 25 bp rate cut remains likely (~86% probability) despite recent sticky inflation. November CPI is expected to show headline +0.3% m/m (y/y rising to 2.7%) and core CPI +0.3% m/m (unchanged y/y at 3.3%). The report comes amid mixed momentum, scrutiny on big tech valuations, and external responses to US trade and tariff policies. Treasury will auction $39B in 10-year notes today, followed by Thursday’s PPI, initial claims, and $22B in 30-year bonds.

Corporate highlights:

- GEV -7.3%: Weak Investor Day guidance following a 60%+ rally over three months.

- GM -3.1%: Ending funding for Cruise robotaxi development.

- BKNG -1.8%: Announced cost reduction plan.

- GME +4.2%: Q3 sales light but EPS beat on stronger gross margins.

- PDCO +5.1%: Announced acquisition for ~$4.1B.

- PLAY -9.6%: Third straight comp miss, softer EBITDA, CEO exit.

- SFIX +12.7%: EBITDA beat, raised FY25 guidance.

US equities ended lower on Tuesday, with the Dow down 0.35%, S&P 500 off 0.30%, Nasdaq down 0.25%, and Russell 2000 down 0.42%. The session closed near worst levels despite mixed performance from big tech, with GOOGL (+5.6%) and TSLA (+1.3%) notable gainers. Laggards included semiconductors, homebuilders, industrial metals (X -9.7%), and REITs, while airlines, cruise lines, regional banks, and asset managers saw relative strength. Treasuries weakened across the curve, the Dollar Index rose 0.2%, gold increased 1.2%, Bitcoin futures rose 0.2%, and WTI crude gained 0.3%.

Markets are focused on Wednesday’s November CPI release, expected to show headline CPI increasing 0.3% m/m (y/y growth to 2.7%), with the core rate also up 0.3% m/m (y/y unchanged at 3.3%). The Fed blackout period continues ahead of the 18-Dec FOMC meeting, where a 25 bp rate cut remains highly probable (~85%). Positive sentiment surrounded NFIB small-business optimism, which rose to its highest level since June 2021. M&A headlines and regulatory updates also featured prominently, including President Biden reportedly blocking Nippon Steel’s acquisition of US Steel.

Company-Specific News by GICS Sector

Information Technology

- Oracle (ORCL -6.7%): Fiscal Q2 revenue and EPS missed expectations, with Q3 guidance only in line at the high end. FX headwinds, a $2B sequential decline in RPO, and implied Q4 ramp were flagged as concerns, though AI cloud infrastructure commentary was positive.

- MongoDB (MDB -16.9%): Despite a Q3 earnings and revenue beat, shares fell on muted Atlas consumption growth, elevated expectations, and CFO/COO Michael Gordon’s announced resignation.

- Pinterest (PINS -3.7%): Downgraded to neutral by Piper Sandler on inconsistent financial performance and challenges in the ad market.

Consumer Discretionary

- Toll Brothers (TOL -7.0%): Delivered Q4 earnings, revenue, and backlog ahead of expectations. However, weaker FY25 gross margin guidance led to a downgrade by KBW.

- eBay (EBAY -2.9%): Downgraded to underperform at Jefferies, citing a slowdown in China and advertising growth pressures impacting margins.

- Ollie’s Bargain Outlet (OLLI +13.2%): Reported a Q3 earnings beat, though revenue was light. Strong margin performance and membership growth helped offset trimmed FY revenue and comp guidance.

- G-III Apparel Group (GIII +10.4%): Q3 EPS beat with inventories down 10% y/y. FY25 EPS guidance raised, supported by improved gross and operating margins.

- Norwegian Cruise Line (NCLH +1.7%): Upgraded to buy at Goldman Sachs, citing valuation below pre-COVID levels and strong industry demand momentum.

Industrials

- Boeing (BA +4.5%): Restarted 737 MAX production last week, according to Reuters.

- United States Steel (X -9.7%): Bloomberg reported President Biden is set to block Nippon Steel’s acquisition of US Steel, citing antitrust concerns.

Healthcare

- HealthEquity (HQY -5.6%): Q3 EPS and revenue slightly ahead; FY26 revenue guidance fell short. Analysts flagged likely conservative outlook amid CEO transition.

- Yext (YEXT -17.1%): Q3 earnings met expectations with revenue ahead. FY25 revenue guidance at the low end of prior range disappointed, with growth tied to Hearsay.

Consumer Staples

- United Natural Foods (UNFI +20.0%): FQ1 beat on earnings and revenue, driven by strong sales from chains and volume growth from new customers. FY25 guidance raised.

- Albertsons (ACI -2.3%): Federal judge blocked merger with Kroger (KR +5.1%), siding with the FTC over antitrust concerns.

Communication Services

- Alphabet (GOOGL +5.6%): Announced quantum computer breakthrough using the Willow chip, which solved a problem in five minutes that would take a supercomputer 10 septillion years.

- Sirius XM (SIRI -12.3%): FY25 revenue, EBITDA, and FCF guidance below expectations; company plans to refocus on the auto market and reduce spending on high-churn streaming audiences.

Financials

- Rocket Cos. (RKT -5.6%): Downgraded to underperform by KBW on concerns about FY25 EPS, ambitious purchase market share guidance, and potential founder stock sales.

- Voya Financial (VOYA -9.4%): Cited higher-than-expected loss ratios for January 2024 policy year, with premium declines forecasted for January 2025.

- Vimeo (VMEO +4.6%): Upgraded to overweight at Piper Sandler on accelerating enterprise business and cost structure improvements.

Materials

- Dow (DOW +1.8%): Announced sale of a 40% stake in Gulf Coast infrastructure assets to Macquarie Asset Management for $2.4B.

Eco Data Releases | Wednesday December 11th, 2024

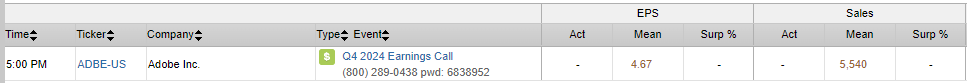

S&P 500 Constituent Earnings Announcements | Wednesday December 11th, 2024

Data sourced from FactSet Research Systems Inc.