February 25, 2025

S&P futures are down 0.1% after U.S. equities finished mostly lower on Monday, with tech leading declines (-1%) and the Mag 7 hitting its lowest level since December. AI capex stocks, China ADRs, EVs, builders, machinery, rails, and trucking were among the weakest areas, while healthcare, insurance, and travel/leisure outperformed. Despite the overall market weakness, about 60% of S&P 500 stocks managed to close in positive territory. Treasuries saw strong gains, the dollar index edged up 0.1%, gold fell 0.4%, Bitcoin futures dropped 5.2%, and WTI crude declined 0.2%.

Trump administration policy uncertainty remains a key market overhang, with the White House reiterating that tariffs on Canada and Mexico will take effect next month, while also moving to tighten chip export restrictions on China, adding pressure to global semiconductor stocks. In Washington, House Republicans continue struggling to finalize a reconciliation bill featuring a TCJA extension, though there has been some progress in government funding talks. However, Democrats are pushing for assurances that Trump will honor previously agreed-upon spending limits.

The AI capex investment cycle is facing scrutiny, with Microsoft (MSFT) reaffirming its capex guidance, but investors questioning whether demand will justify spending levels. Heavy retail selling was flagged on Monday, adding to concerns about waning buying momentum in the market.

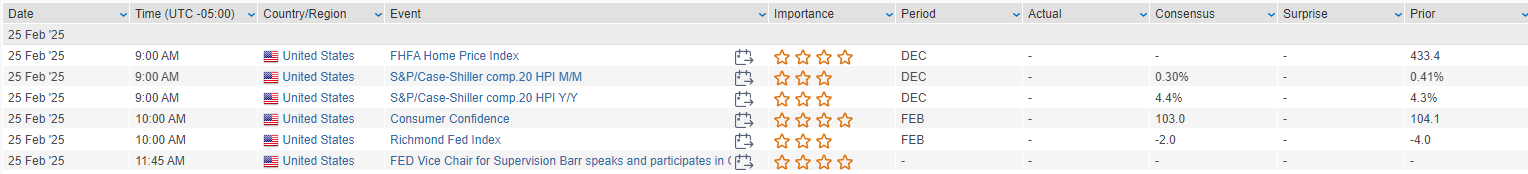

The economic calendar today includes consumer confidence, the Richmond Fed manufacturing index, and home price data, with additional attention on consumer sentiment after last week’s disappointing University of Michigan reading. The Treasury will auction $70B in 5-year notes, while Fed officials Barr and Barkin are scheduled to speak. The House may vote on its reconciliation bill outline, but passage remains uncertain, with Medicaid cuts a key sticking point.

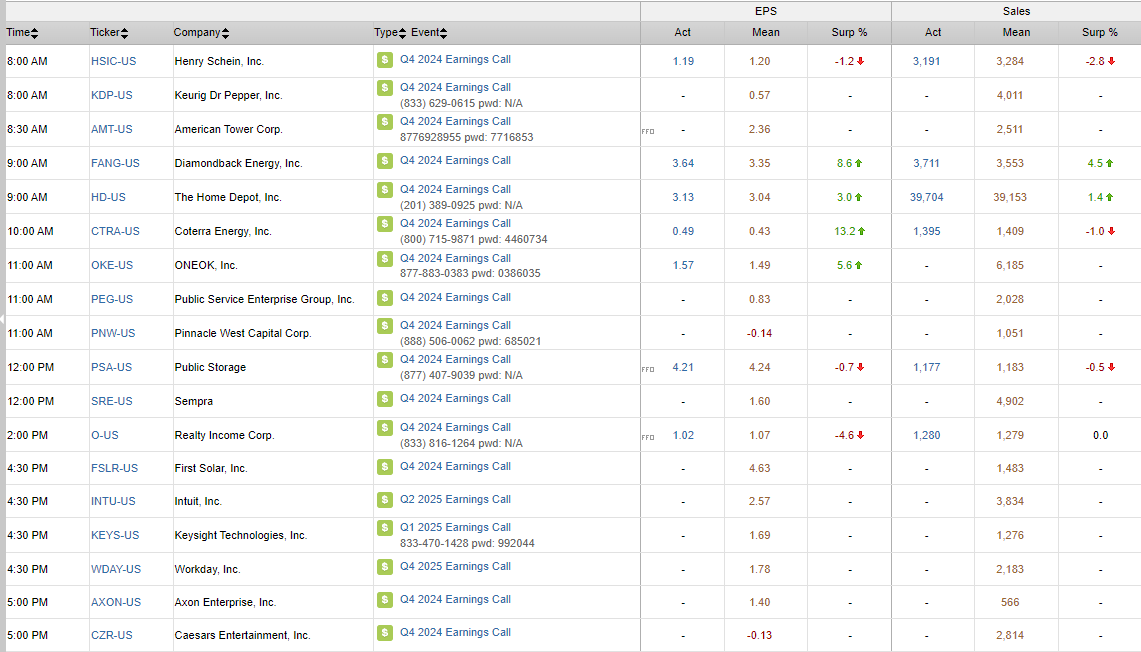

Nvidia (NVDA) is reportedly seeing a sharp increase in H20 AI chip orders from Chinese firms following DeepSeek’s AI breakthrough. Home Depot (HD) reported better-than-expected Q4 results, but provided light FY25 guidance. Zoom (ZM) declined as concerns grow over its limited top-line growth potential. SBA Communications (SBAC) posted a slight Q4 beat, but issued weaker-than-expected FY25 AFFO and EBITDA guidance.

Hims & Hers Health (HIMS) sold off on concerns about its 2025 revenue dependence on weight-loss drugs. Zions Bancorporation (ZION) announced a $40M share repurchase authorization. KBR (KBR) exceeded expectations on Q4 results and guidance, despite ongoing Department of Energy contract uncertainty. Cliffs Natural Resources (CLF) disappointed with worse-than-expected free cash flow burn.

Trex (TREX) provided FY25 guidance that came in slightly better at the midpoints. Sonos (SONO) announced a $150M share repurchase program. Ultra Clean Holdings (UCTT) missed expectations and guided Q1 well below Street estimates. Callaway (MODG) delivered a Q4 beat but issued softer guidance, citing FX headwinds, tariffs, and calendar changes. Jack in the Box (JACK) announced that CEO Darin Harris has resigned.

Chegg (CHGG) fell sharply on much weaker Q1 guidance and the launch of a strategic review process.

U.S. equities ended mostly lower on Monday, extending last week’s losses, with the S&P 500 down 0.50%, the Nasdaq falling 1.21%, and the Russell 2000 declining 0.78%. The Dow managed a modest 0.08% gain. Big tech underperformed, with Nvidia (NVDA) as the worst performer, while Meta (META) fell for the fifth straight session after 20 consecutive gains. Other laggards included semiconductors, rails, EVs, engineering & construction, housing-related retail, utilities, and Chinese tech stocks. Outperforming sectors included property & casualty insurers, airlines, pharma/biotech, REITs, apparel, casual dining, telecom, media, food, cosmetics, and tobacco.

Treasuries strengthened, with steepening in the yield curve, while a $69B 2-year auction was well received. The dollar index was flat, gold rose 0.3%, Bitcoin futures dipped 0.2%, and WTI crude settled up 0.4%.

Markets attempted to rebound but failed to hold early gains, with continued concerns over government funding, weaker corporate guidance, and fading retail investor sentiment. Trump reaffirmed plans to impose tariffs on Mexico and Canada starting March 4. House Republicans remain divided on a budget resolution tied to Trump’s legislative priorities, including the TCJA extension, with a potential government shutdown looming ahead of the March 14 deadline.

The Dallas Fed manufacturing index missed expectations, reflecting rising cost pressures and business concerns over immigration and trade policy. The Treasury’s 2-year note auction saw strong demand. Key data this week includes consumer confidence, home price indices, new home sales, Q4 GDP revision, durable goods orders, initial jobless claims, and PCE inflation, with multiple Fed speakers scheduled, including Barr, Barkin, Bostic, and Goolsbee.

Company News by Sector

Information Technology (XLK) -1.43%

- Microsoft (MSFT): Pulled back after TD Cowen reported it is canceling significant U.S. data center leases, possibly linked to a shift in OpenAI’s infrastructure needs. Microsoft reiterated its $80B capex target, and analysts pointed to potential benefits for Oracle (ORCL) as an alternative provider.

- Alphabet (GOOGL): Announced a seven-year, $2.5B cloud partnership with Salesforce (CRM), expanding AI and cloud services.

- Twilio (TWLO) +3.1%: Upgraded to overweight at Morgan Stanley, citing positive customer feedback and expected AI-driven margin expansion.

Consumer Discretionary (XLY) -0.87%

- Domino’s Pizza (DPZ) -1.5%: Reported Q4 EPS, U.S. comps, and revenue below expectations, though international comps outperformed. Raised its quarterly dividend by 15.2%.

- Nike (NKE) +5.0%: Upgraded to buy at Jefferies, citing renewed innovation, improved wholesale distribution, and low market expectations.

- Lucid Group (LCID) -9.2%: Downgraded to sell at Redburn Atlantic, with concerns over scaling its mid-sized platform post-2026 and potential need for additional capital due to prolonged cash burn.

- Rivian (RIVN) -7.9%: Downgraded to neutral at Bank of America, citing soft 2025 outlook, increased competition, weaker EV demand, and complications from a potential Volkswagen (VWAGY) partnership.

- Wingstop (WING) +1.0%: Upgraded to buy at Guggenheim, forecasting flat-to-slightly negative comparable sales in Q2 before reaccelerating in the second half of 2025.

Financials (XLF) +0.45%

- Bridge Investment Group (BRDG) +33.8%: Announced it will be acquired by Apollo Global Management (APO) in a $1.5B all-stock deal, valuing shares at $11.50, a 45% premium to Friday’s close.

- Walgreens Boots Alliance (WBA) +6.5%: Rose on market chatter that banks are structuring ~$10B in financing for a potential buyout by Sycamore Partners.

Healthcare (XLV) +0.75%

- RTX Corporation (RTX) +1.7%: Upgraded to buy at UBS, citing growth drivers in international defense, commercial aerospace, and GTF engine modifications.

- Summit Therapeutics (SMMT): Announced a trial partnership with Pfizer (PFE) focused on infectious disease treatments.

Industrials (XLI) -0.44%

- Steel Dynamics (STLD) +1.9%: Raised its quarterly dividend by 9% and boosted its share buyback authorization by $1.5B.

Real Estate (XLRE) +0.35%

- REITs outperformed, benefiting from bond yield easing and Treasury curve steepening.

Energy (XLE) +0.11%

- BP (BP): Announced plans to abandon prior renewable energy targets, shifting focus back to traditional fossil fuels.

Communication Services (XLC) -0.63%

- Uber (UBER): CEO stated that Tesla (TSLA) robotaxis will not be integrated into Uber’s rideshare platform, countering recent speculation.

- Altice USA (ATUS): Reached a deal with MSG Networks (MSGN) to restore regional sports programming in New York.

- Robinhood (HOOD): Announced that the SEC will close its crypto investigation without enforcement action, removing a key regulatory overhang.

Materials (XLB) -0.18%

- Century Aluminum (CENX) +6.6%: Upgraded to outperform at BMO Capital Markets, citing strong valuation and a positive aluminum price outlook.

- Fresh Del Monte Produce (FDP) -3.0%: Reported better-than-expected Q4 earnings but weaker revenue, citing lower banana prices and Costa Rica flood damage impacting melon supply.

Eco Data Releases | Tuesday February 25th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday February 25th, 2025

Data sourced from FactSet Research Systems Inc.