March 18, 2025

S&P futures down 0.4% in Tuesday premarket trading, near session lows. Follows Monday’s second straight gain, the S&P’s first two-day win streak since Feb. 19, with equal-weight S&P and cyclicals outperforming while Mag 7 lagged. Asian markets extended gains for a third session, with Hong Kong (+2.5%) and Japan (+1%) leading. European markets up ~0.8%. Treasuries mixed with curve steepening. Dollar down 0.1%. Gold +0.9%. Bitcoin -2.1%. WTI crude +1.6% amid renewed Middle East tensions.

Markets remain cautious ahead of April 2 reciprocal tariff decision, with uncertainty around implementation details adding to concerns. Geopolitics in focus with Trump-Putin call on Ukraine ceasefire, with Trump noting “many elements agreed to, but much remains”. US-UK trade talks also underway. FOMC rate decision, Powell presser, and updated SEP on Wednesday, with expectations for lower growth, higher inflation, and median dot holding at two rate cuts for 2025.

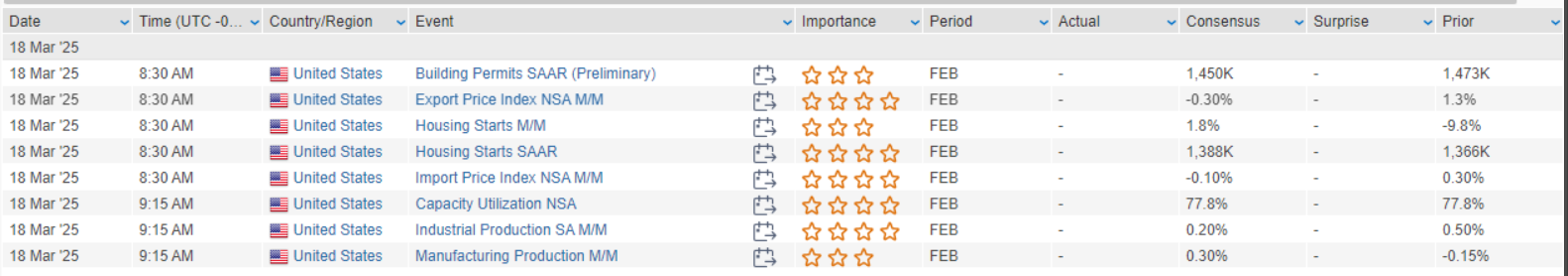

Economic data today: Housing starts/building permits, import prices, industrial production. Key events: German Bundestag vote on spending, NVDA’s GTC keynote (1 PM ET), and Israeli military strikes in Gaza raising Middle East concerns.

Corporate highlights:

- GOOGL back in talks to acquire Wiz for ~$30B after failing to close a ~$23B deal last year.

- AMZN considering cutting 14K managerial positions by March-end.

- BIDU up on release of two new AI models.

- WFC confirmed OCC terminated 2021 consent order.

- STLD guided Q1 EPS slightly below consensus.

- BTU & coal stocks higher after Trump authorized increased coal power production.

- NVDA CEO Jensen to give GTC keynote at 1 PM ET.

- ADBE, GLW, BOX holding analyst meetings

U.S. equities finished higher on Monday, extending Friday’s rebound, with the S&P 500 logging its first two-day gain since its Feb. 19 record high. Gains were broad-based, with equal-weight S&P outperforming its cap-weighted counterpart, reflecting strength outside of mega-cap tech. Energy, financials, and industrials led the market, while big tech was mixed, with TSLA a notable laggard. Treasuries were mixed, with the curve flattening as short-term yields edged higher. The dollar weakened (-0.3%), while gold (+0.2%) and oil (+0.6%) gained. Bitcoin futures slipped 0.1%.

Key drivers included positive consumer spending takeaways from stronger-than-expected core retail sales data, which helped offset concerns over softer headline retail sales and a sharp drop in the Empire manufacturing index. Investors also monitored tariff uncertainty, with no major trade-related headlines over the weekend, though April 2 reciprocal tariff announcements remain a looming overhang. Market sentiment remains cautious, as investors weigh Trump 2.0 policy uncertainty and its impact on consumer and corporate behavior, while China’s latest economic data showed signs of improvement, supporting sentiment.

On the economic front, February retail sales rose 0.2% m/m, missing the 0.7% consensus estimate, while January’s decline was revised lower. However, core retail sales (control group) jumped 1.0%, well above forecasts, easing concerns about consumer retrenchment. The March Empire Manufacturing Index fell sharply (-20.0 vs. +1.5 expected), with new orders contracting and prices rising, while NAHB housing market index slipped to its lowest level since August. Looking ahead, housing starts, building permits, import prices, and industrial production data arrive Tuesday, while the FOMC decision and Powell’s press conference are on tap for Wednesday.

Looking Ahead

- Tuesday: Housing starts, building permits, import prices, industrial production.

- Wednesday: FOMC rate decision, Powell press conference, updated SEP (likely showing lower growth, higher inflation, unchanged dot plot with two cuts).

- Thursday: Jobless claims, Philly Fed manufacturing.

- Friday: Fed’s Williams speaks

GICS Sector Highlights

Energy (+1.56%)

Materials (+1.14%)

- X (United States Steel) +2.9% – DOJ extended deadlines for CFIUS litigation, allowing more time for talks between U.S. officials, X, and Nippon Steel.

Financials (+1.17%)

- BX (Blackstone) +4.9% – Upgraded to buy at UBS, citing valuation resilience amid redemption restrictions.

- DFS (Discover Financial) -6.9% – Reports that DOJ staff found COF-DFS merger could be anticompetitive in subprime lending, raising regulatory concerns.

Industrials (+1.35%)

- SAIC (Science Applications) +7.2% – Q4 earnings beat, raised FY26 guidance, highlighted volume ramp in new and existing contracts, secured large recompete award.

- FLS (Flowserve) +2.8% – Upgraded to outperform at Baird, citing valuation, revenue growth, and margin expansion potential

Consumer Discretionary (-0.44%)

- GES (Guess?) +30.1% – WHP Global submitted a non-binding offer to take Guess? private at $13 per share.

- AEO (American Eagle) +8.8% – Announced $200M accelerated share repurchase program.

- TSLA (Tesla) -4.8% – Mizuho cut price target to $430 from $515, citing weak February sales, geopolitical risks, and softening EV demand.

- NCLH (Norwegian Cruise Line) +4.4% – Upgraded to overweight at JPMorgan, citing strong demand resilience despite macroeconomic concerns.

Technology (+0.18%)

- INTC (Intel) +6.8% – Incoming CEO plans AI-focused restructuring, staff reductions, and new efforts to attract chip customers.

- NFLX (Netflix) +3.5% – Upgraded to buy at MoffettNathanson, citing underappreciated monetization potential and improving margin expansion.

- MNDY (Monday.com) +3.9% – Upgraded to buy at DA Davidson, citing valuation and large-customer traction.

- AFRM (Affirm) -4.2% – CNBC reported Klarna replaced AFRM as Walmart’s BNPL provider, raising competition concerns.

Healthcare (+1.14%)

- INCY (Incyte) -8.6% – Phase 3 trial results for povorcitinib in HS disappointed, missing investor expectations.

Consumer Staples (+1.55%)

- PEP (PepsiCo) – Acquiring poppi for $1.95B, further expanding into the functional beverage market.

Real Estate (+1.65%)

- IIPR (Innovative Industrial Properties) -7.8% – Major tenant PharmaCann (~17% of revenues) defaulted on rent, raising concerns about future collections.

Utilities (+0.40%)

- NEE (NextEra Energy) -2.0% – CEO to retire on May 22, CFO Bolster to take over as successor.

Eco Data Releases | Tuesday March 18th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday March 18th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.