March 3, 2025

S&P futures up 0.2% in Monday morning trading, following a late-session rally Friday tied to month-end pension fund rebalancing. However, stocks ended lower for the week, with big tech dragging the Nasdaq down nearly 3.5%. February also saw equities retreat despite early-month gains that pushed the S&P 500 to an all-time high on February 19.

Overnight, Asian markets mostly higher, with Nikkei up 1.5%, while European markets gained ~0.5%. Treasury yields rising after falling for five straight weeks, with the 10-year down nearly 25 bp last week. Dollar down 0.5%, gold off 0.5%, Bitcoin down 1.2% after a Sunday rally on Trump’s US Crypto Reserve announcement. WTI crude down 0.6%.

Markets attempting to extend Friday’s rebound amid tariff speculation and comments from Commerce Secretary Lutnick suggesting a lower-than-expected tariff rate for Canada and Mexico, though China’s 10% tariff remains on track. Trump also ordered an investigation into lumber imports on national security grounds. Treasury Secretary Bessent’s weekend remarks on inflation, tariffs, and China seen as supportive. Reports Germany is considering a $400B+ defense and infrastructure fund also noted as a potential tailwind.

Key economic data this week:

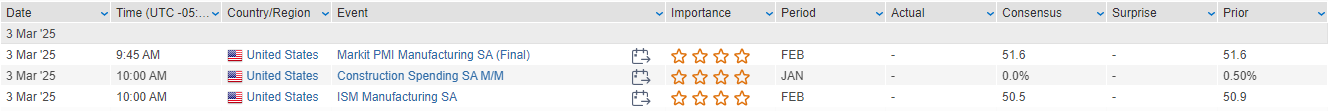

- Monday: ISM manufacturing, final S&P Global US manufacturing PMI, construction spending.

- Tuesday: NY Fed’s Williams speaks; Trump delivers State of the Union.

- Wednesday: ADP private payrolls, ISM services, factory orders, Beige Book.

- Thursday: Trade balance, Q4 productivity, unit labor costs, initial claims, wholesale inventories.

- Friday: February employment report; Fed’s Powell, Williams, and Kugler scheduled to speak.

Corporate highlights:

- NVDA reportedly receiving Chinese orders for its latest chips, circumventing US export controls.

- TSLA February sales in France down >25% y/y, with European revenue from emissions credits at risk.

- APP adjusted buyback rules to allow more flexibility.

- SMCI announced plans for a third Silicon Valley campus.

- ALGM up on reports of takeover interest from ON.

- CPRI nearing a $1.6B deal to sell Versace to Prada

U.S. equities rebounded on Friday, with the S&P 500 gaining 1.59%, the Nasdaq rising 1.63%, and the Dow climbing 1.39%, though these gains only partially recovered Thursday’s sharp losses. The S&P 500 and Nasdaq still recorded their worst weekly performances since September as volatility in big tech, macroeconomic uncertainty, and trade policy concerns weighed on sentiment.

Markets responded positively to January’s core PCE inflation reading of +0.3% m/m, which was in line with expectations and marked the lowest annualized increase (2.6%) since June. However, consumer spending unexpectedly declined by 0.2%, reinforcing concerns about slowing economic momentum, particularly following last week’s weaker Consumer Confidence report and Walmart’s (WMT) cautious guidance.

Geopolitical tensions escalated after Ukrainian President Zelensky left a tense White House meeting without signing a minerals deal, which had been expected as the centerpiece of his visit. Trump told Zelensky that Ukraine must “make a deal” or risk losing U.S. support, further adding to uncertainty about U.S. foreign policy under his administration.

Treasuries firmed across the curve, extending a weeklong decline in yields. The U.S. dollar strengthened (+0.3%), while gold fell 1.6%, and Bitcoin rebounded 1%, after earlier dipping below $80K. WTI crude oil slipped 0.8%.

Sector Performance & Key Company News

Technology (+1.71%)

- Nvidia (NVDA) stock rebounded after recent declines, though concerns remain about gross margin guidance.

- HP Inc. (HPQ) -6.8%: Q1 revenue beat but EPS slightly missed. Weak Q2 EPS guidance and lower FY25 free cash flow outlook. Tariffs factored into Q2 and full-year guidance.

- Dell Technologies (DELL) -4.7%: Q4 revenue light, but EPS exceeded expectations on gross margin strength. FY26 guide more in line, with AI server demand seen as a tailwind. Announced a $10B share buyback.

- NetApp (NTAP) -15.6%: Q3 EPS in line, but revenue and gross margins missed. Q4 guidance below consensus, citing inconsistent execution and deal slippage.

Financials (S&P 500: +2.07%)

- Rocket Companies (RKT) +9.1%: Strong Q4 earnings and revenue beat. Origination volume and gain-on-sale margin ahead of consensus. Analysts positive on AI-driven efficiency improvements.

Consumer Discretionary (S&P 500: +1.80%)

- Monster Beverage (MNST) +5.3%: Q4 revenue, gross margin, and EBIT exceeded expectations. International sales strong, though U.S. sales lagged. Analysts cited potential pricing actions and category resurgence.

- Signet Jewelers (SIG) +5.2%: Holder Select Equity Group (9.7% stake) urged strategic review, citing weak FCF impact on enterprise value.

Healthcare (S&P 500: +1.22%)

- Acadia Healthcare (ACHC) -25.5%: Q4 revenue, earnings, and EBITDA margins missed expectations. Q1 and FY25 guidance cut. Approved a $300M share buyback.

- Recursion Pharmaceuticals (RXRX) -2.1%: Q4 revenue and earnings missed, R&D expenses above consensus. Announced $500M equity sales agreement.

Industrials (S&P 500: +1.34%)

- Mastec (MTZ) +4.5%: Strong Q4 earnings, EBITDA, and free cash flow. Backlog growth supports 2025 outlook.

Materials (S&P 500: +0.86%)

- Mosaic (MOS) +3.1%: Q4 EBITDA beat, supported by strong phosphate pricing.

Utilities (S&P 500: +1.41%)

- AES Corp (AES) +11.7%: Q4 EPS and revenue beat, with FY25 EPS guidance ahead of consensus. Noted strong renewable energy demand from AI data centers and U.S. manufacturing projects.

Communication Services (S&P 500: +1.37%)

- DoubleVerify (DV) -36%: Q4 revenue and EBITDA missed, with Q1 guidance below consensus. Analysts flagged a shift in ad spending away from open web and toward social video.

Energy (S&P 500: +1.53%)

- Bloom Energy (BE) +3.8%: Strong Q4 product revenue growth and margin improvement.

Eco Data Releases | Monday March 3rd, 2025

S&P 500 Constituent Earnings Announcements | Monday March 3rd, 2025

No constituents scheduled to report today

Data sourced from FactSet Research Systems Inc.