ETF Insights | January 1, 2025 | Consumer Staples Sector

S&P 500 Staples Sector Price Action & Performance

Staples finish up 2024 in a deeply oversold condition after a decline of almost 6% in December. The RSI study (chart below, bottom panel) has been at oversold levels for the past 2 weeks as investors sold out of the sector in the face of rising interest rates. For the year, Staples lagged the S&P 500 by >10% as consumers shifted buying patterns away from established premium brands for more cost-conscious options like private label and discount retailers.

S&P 500 Staples Sector: Industry Performance Trends

At the industry level, Food & Staples Retailing continues to be a positive standout. Tobacco has also outperformed the S&P 500 over the past 12 months. Weakness manifested in Personal Products, Beverages and Household products as price conscious consumers looked for deals and traded down from established brands.

S&P 500 Staples Sector Breadth

Sector level breadth is washed out with only 12.5% of constituent stocks above their 50-day moving averages. The % of declining stocks hit >90% several times in December showing capitulation selling. This is either an excellent accumulation opportunity or the start of a deeper correction. We think the direction of interest rates in the first half of 2025 will be a big determinant of the outcome. We are betting on rates softening based on our positioning to start the year.

S&P 500 Staples Sector Top 10 Stock Performers

Down and out stocks were the best performers in December with DLTR, WBA EL and TGT posting >4% gains. We’re more partial to WMT and KR.

S&P 500 Staples Sector Bottom 10 Stock Performers

Food and Beverage stocks were hit particularly hard

S&P 500 Staples Sector Fundamentals

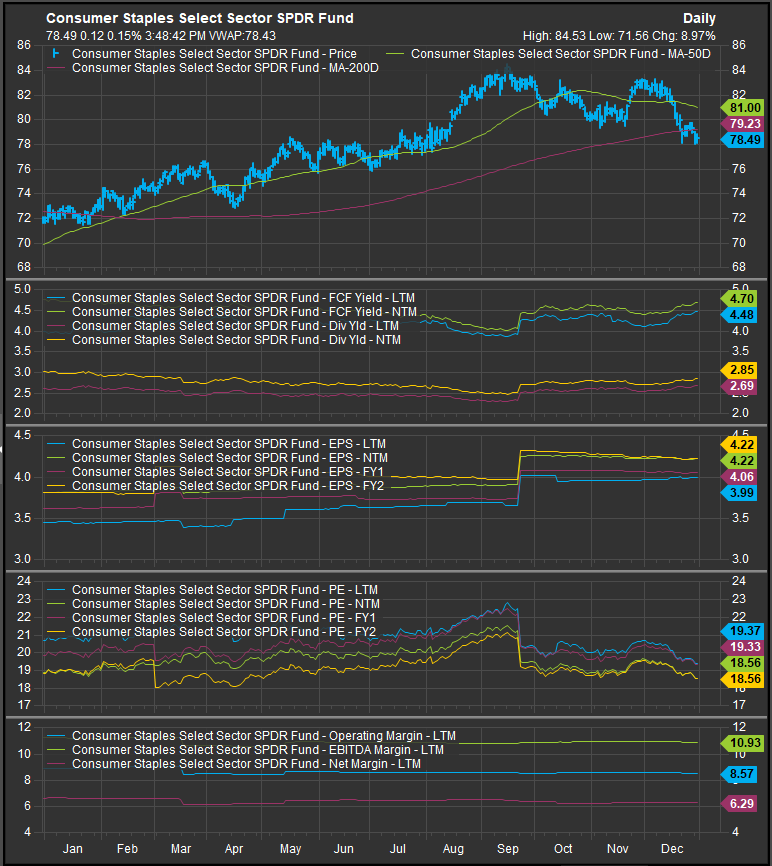

The chart below shows S&P 500 Staples Sector FCF yield, and Dividend Yield as well as projected earnings over the next 3 years, valuation and trailing margins. Not much earnings upside for Staples on a forward basis. Consensus estimates were re-rated higher on stimulus hopes but rising market rates have undone that optimistic assessment.

Economic and Policy Developments

Persistent inflation continued to shape consumer behavior in December, influencing spending patterns toward essential goods. Rising costs for groceries and household items remained a focal point, with food-at-home prices significantly outpacing overall inflation earlier in the year. Despite this, November retail sales data indicated a strong consumer appetite for essentials, supporting staples demand.

At the same time, the Federal Reserve’s easing cycle provided some relief to household finances, although elevated borrowing costs continued to weigh on discretionary spending. Credit card defaults reached their highest levels since 2010, signaling potential stress among lower-income households and raising concerns about their ability to maintain stable staples consumption.

Trade policy uncertainty under the prospective “Trump 2.0” administration added a layer of complexity to the sector. Potential new tariffs on imported goods, including consumer staples, could disrupt supply chains and increase costs for both producers and consumers. However, expectations for deregulation across the retail and agricultural sectors were seen as positive for staples companies looking to streamline operations and reduce compliance costs.

Additionally, legislative debates surrounding the Farm Bill and related subsidies could influence commodity prices and agricultural supply chains, directly affecting the cost structures of food producers and retailers.

2025 Outlook

The S&P 500 Consumer Staples sector is positioned for a stable yet cautious 2025, driven by ongoing consumer demand for essentials and the sector’s defensive characteristics. Companies with strong brand equity and pricing power, such as Coca-Cola and Procter & Gamble, are expected to maintain steady performance, leveraging their ability to navigate inflationary pressures and changing consumer preferences.

However, risks remain. Persistent inflation and elevated interest rates could further strain household budgets, leading to shifts in spending toward value-oriented options and private-label products. Additionally, geopolitical and trade uncertainties could impact supply chains and increase costs, particularly for companies reliant on imported raw materials.

The sector is likely to benefit from potential regulatory relief under a pro-business administration, which could ease operational burdens and support profitability. However, slower global economic growth and uneven demand recovery in key international markets, such as China and Europe, could temper overall performance.

Overall, the Consumer Staples sector is expected to provide stability in portfolios amid broader market volatility, with companies focused on innovation, cost management, and consumer-centric strategies likely to outperform.

In Conclusion

Staples finished 2024 as a laggard, but the sector could benefit if rising rates stoke recession fears and spur investors to de-risk their equity portfolios. We are short low volatility in aggregate, but we start 2025 with an overweight position of +1.99% vs. the S&P 500 for the Staples Sector in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.