ETF Insights| November 1, 2024 | Consumer Staples Sector

Price Action & Performance

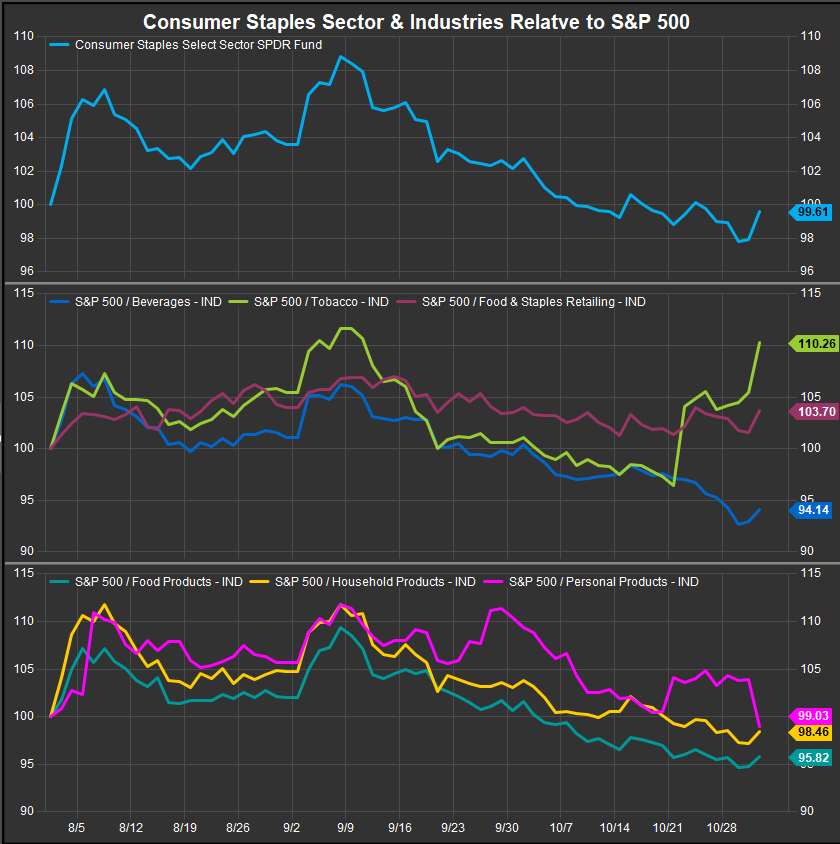

September proved to be a bull-to-bear pivot for the Staples Sector as the Fed’s move to kickstart easing with a 50bp cut and an aggressive tone at the time of the meeting had investors swapping defensive exposure for offensive. The Staples Sector has given back almost all relative gains from mid-July through early September and sits near YTD relative lows.

At the industry level, the Staples Retailing and Distribution industry (formerly Food & Staples Retailing) remains the long-term outperformer and the only real bright spot within the sector. Tobacco stocks have bounced back in the near-term and are the only other Staples industry that has outperformed the broad market over the past 6-months. Beverages, Food Products, Household Products and Personal Products industries all remain in relative downtrends vs. the S&P 500, and we aren’t seeing positive signs there.

At the stock level we aren’t finding many stocks that look like buys in our process. WMT and COST remain the best charts in the sector by a wide margin. We give the benefit of the doubt to PM and KVUE as buy-rated in our work, but, similar to the industry level performance, most stocks continue to languish in consolidation or outright downtrend even as the S&P 500 bull market continues.

Economic and Policy Drivers

Dovish policy has spurred a backup in interest rates which is causing complications for equity investors as they attempt to position for a soft landing/no landing scenario. The Fed is in the game in the first place because Industrial and Consumer data had been softening due to inflation pressures, mortgage costs, labor costs and aggregate price gains over the past 5 years. Now that rates are moving higher on bullish rotation into equities from more conservative fixed income assets, the market is no longer cooperating with the Fed’s narrative and the consumer is at risk of getting squeezed again.

Staples companies typically operate lower margin businesses with a broad array of essential products. The product categories are typically associated with value-oriented marketing. This has caused consumers to balk at some of the higher prices showing up on store shelves for established brand names. As we’ve heard from the Financial commentariat class, one of the reasons inflation is cooling is because Consumers have begun refusing higher prices. The present behavioral trend is exacerbated by increased competition from private label entrants into the traditional staples categories. The big reach for margin that was sparked by pandemic shortages is now getting pushback from the consumer who is still under pressure despite promises of lower rates ahead.

ESG policies also add a layer of cost that is particularly difficult for the Staples sector. Increased R&D and costs associated with recyclable and reusable packaging is a strain on lower margin businesses that market low price points.

While WMT and COST are benefitting from a continued “value seeking” dynamics in the consumer space, most Staples Co.’s are in the business of selling established brands at a price premium. Those companies, whether Clorox, Proctor & Gamble or Coca Cola are seeing consumers trade out for cheaper substitute products.

In Conclusion

Weaker inflation and a bullish earnings season have put the XLP in the back seat on performance. However, we’ve reached oversold conditions, and we are taking it off our zero-weight list as XLE, XLB and XLV are scoring lower in our process this month. Our Elev8 Sector Portfolio starts November with an OVERWEIGHT position in XLP of +1.58% vs. the benchmark S&P 500

Chart | XLP Technicals

- XLP 12-month, daily price (200-day m.a. | Relative to S&P 500)

- Deeply oversold with rates backed up, we are betting on near-term reversal in November

XLP Relative Performance | Industry Level Relative Performance | Trailing 3-months

Data sourced from FactSet Research Systems Inc.