February 25, 2025

The S&P 500 continues to consolidate over the intermediate term. Despite making marginal new highs in January and February, the chart (below) shows a negative momentum divergence that has become more pronounced in the near-term (chart below, panels 2 & 3). We think a near-term correction could potentially retest the July 2024 high for the Index near the 5670 level.

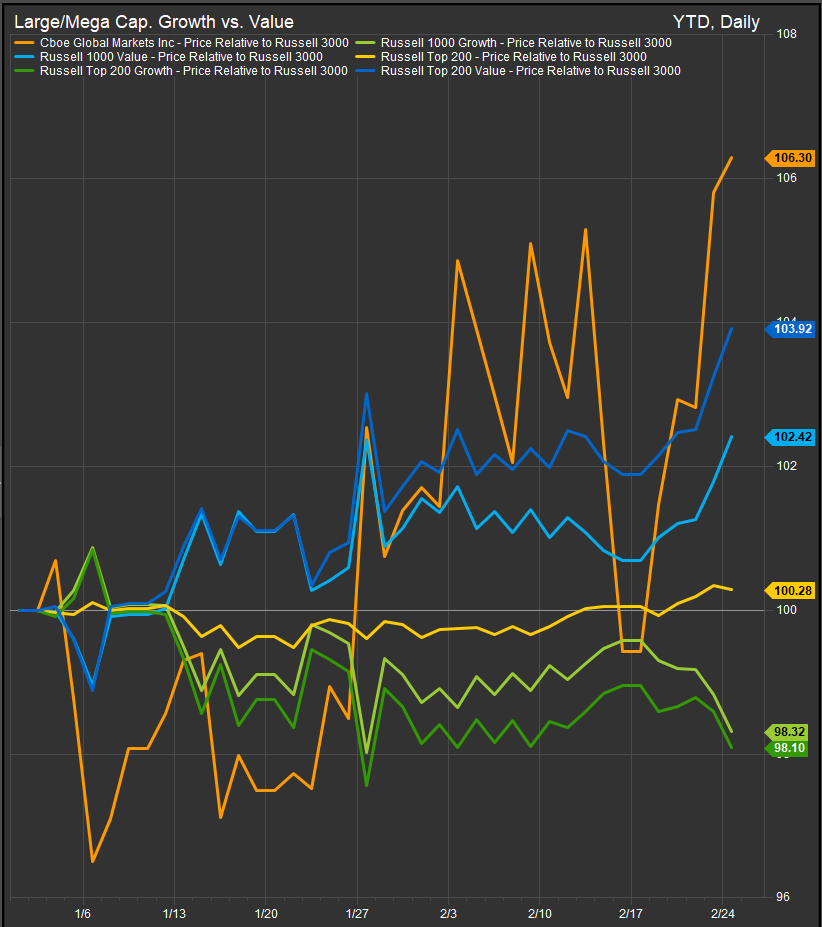

As February has progressed the rally in Growth stocks has lost steam as the mix of tariff news, concern over the economy and skepticism regarding the massive allocation to AI themes has equities consolidating. Looking at Growth and Value factors we see a clear shift in performance that favors the latter. The chart below shows YTD performance over Large and Mega Cap. Growth and Value Factor Indices vs. the Russell 3000. There is a clear preference for Large Cap. Value percolating through the US equity market in the near-term.

Defensive Sectors Continue to Firm

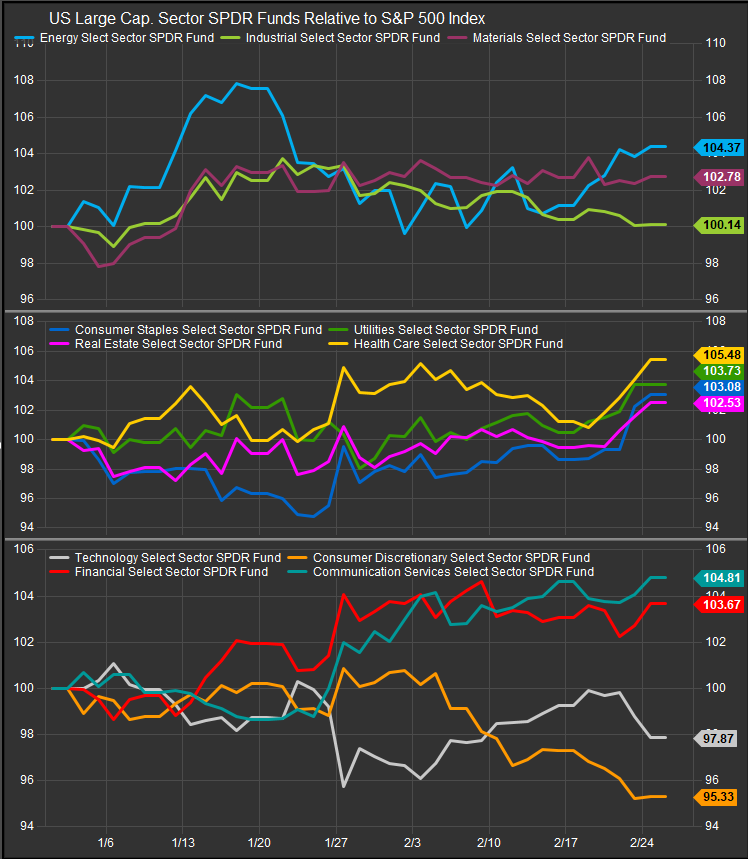

NVDA’s earnings report drops tomorrow and could make everything you’re about to read a moot point, but performance of legacy defensive sectors (chart below, panel 2) has been improving over the YTD at the expense of Technology and Discretionary shares primarily. Healthcare has led the charge, but each of the 4 traditionally defensive sectors has outperformed in 2025.

When looking at the past 12-months of sector performance, we can see that Healthcare in particular has been a consistent laggard, but has seen its performance curve (chart below, panel 2, yellow line) move up to 3-month highs. If we are to get a deeper top-line correction for US equities, we like the setup for Healthcare stocks to continue outperforming here.

Rates and Commodities Prices Moving Lower

The Bloomberg Commodities Index (chart below) is pulling back after testing overhead resistance at the 108-110 level. We interpret the price action as investor concern that tariff dynamics have potential to push the US economy towards recession. We continue to believe the 108-110 level is important resistance and we think a move above that level would signal a re-emergence of inflation dynamics. Notably, this is one up move that is not accompanied by a negative momentum divergence as the RSI and MACD oscillators moved to new highs with the index. The problem for investors is we might be facing a Hobson’s Choice where the alternative to inflation is a bearish correction due to lower-than-expected growth. This is why we think NVDA’s earnings will be key in the near-term.

The US 10yr Yield (chart below) is now near-term oversold, but, looking back 3 years, we can see a long-term negative momentum divergence has developed. As we mentioned, we think inflation would be telegraphed by Commodities prices rising above the 110 level on the Bloomberg Commodities Index. But if tariffs are seen as a threat to economic expansion, we could continue to see rates move lower despite upwards pressure on commodities prices.

Conclusion

From a technical perspective, evidence of buying fatigue continues to mount in the form of negative momentum divergences across Growth-related themes. Commodity price strength historically supports Value stocks rather than Growth and the combination of rising input prices and falling interest rates give the macro picture a recessionary vibe. We think there’s elevated potential for a deeper equity correction in the near-term with defensive sectors firming over the past 3-months after spending a prolonged period of time at the back of the line.

Data sourced from FactSet Research Systems Inc.