Thematic Thursday Sector Report: Low Beta Outperformance in a High-Beta World, December 12, 2024

The Bull market for equities has firmly re-established itself in the second half of 2024. A dovish pivot from the Fed has so far paved the way for an economic “soft landing” and enthusiasm and expectations of deregulation from a 2nd Trump Administration has reinvigorated the market level bid for cyclicality. So far, this re-injection of exuberance has occurred in a context of stable interest rates and Commodities input prices have also remained sluggish which keeps the macro picture on the side of the Bull.

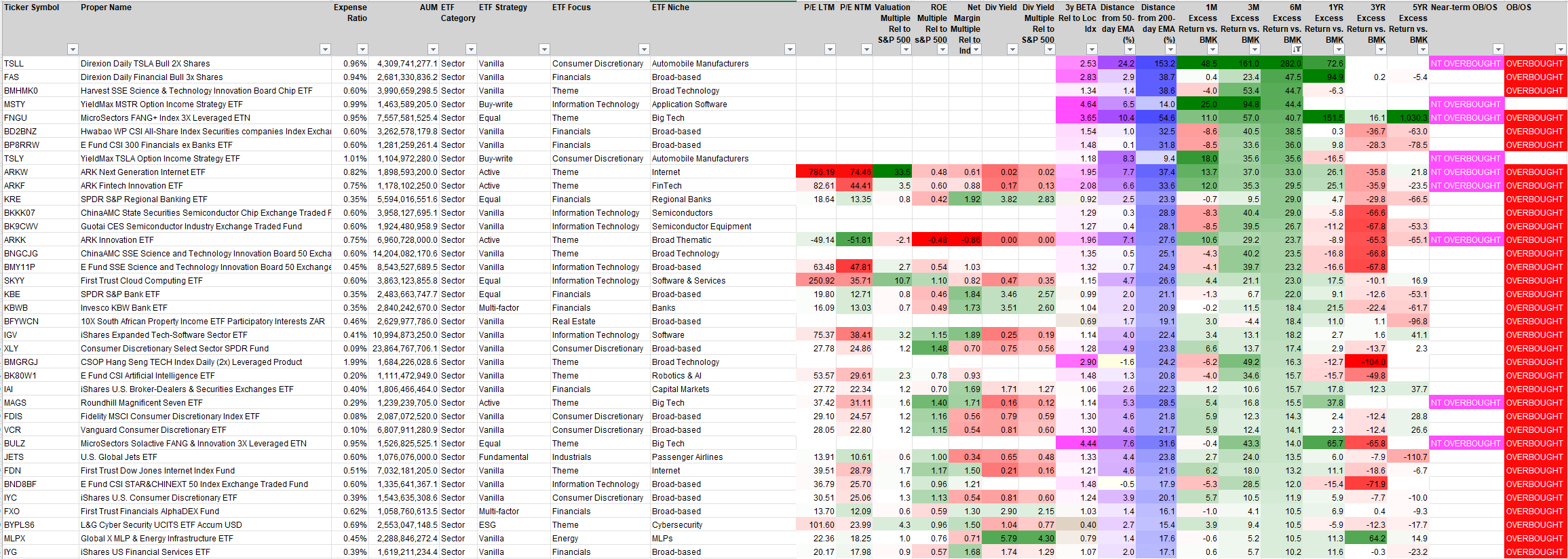

Investors have shown increased risk appetite as proxied by the outperformance of high-beta exposures over the past 6 months. At ETFsector.com, our process of identifying bullish reversals starts with a foundational pre-requisite that the security in question should show outperformance of >10% vs. a standard equity benchmark on a total return basis. This week we looked at our database of 2528 sector and sector thematic ETFs to examine which themes are prevalent among outperformers that pass our bullish reversal threshold of +10% excess return vs. the S&P 500 Index. Below is the full list of ETFs with > $100M AUM.

High-Beta sector funds dominate the rankings of Positive 6-month Excess Returns vs. the S&P 500

Below we list the 36 ETF’s that have met our intermediate-term bullish threshold of +10% excess returns from the highest excess return down to the threshold level. The preference for high beta within the cohort is unmistakable. The top of the list is dominated by levered ETFs like the TSLL Direxion 2x TSLA Shares and the FAS Direxion Daily Financial Bull 3x Shares. Options strategies on big Growth Co.’s are also high up on the list of returns and the list is generally rounded out by exposure to technological innovation, consumer discretionary and financial exposure.

The other point we would make about this list is we are getting an increasing number of “overbought” and “near-term overbought” signals in our work. These signals derive from the distance a stock’s price is ABOVE its 200-day and 50-day moving averages of price. For ETF’s are levels are lower than for individual stocks and they are not outright sell signals, particularly in a bull market. However their prevalence signals an elevated potential for a pause in the dominant trend, and we do expect equities to eventually consolidate prices as some of the messier parts of the Trump Administration agenda get digested by market participants.

We think it is worthwhile to highlight the lower beta areas of outperformance among our basket of ETFs with high AUM.

There are some lower beta funds outperforming, and they may be a very useful ingredient to a portfolio moving forward

While the broad preference among investors is clearly for high beta in the near-term, these 5 ETFs qualify through our technical process as bullish reversals and offer 3yr Beta’s below 1. We are not surprised to see the themes including banking and MLP’s. These have been two under the radar sources of alpha in 2024. Banks in particular offer almost twice the net margin of the S&P 500 but are valued at 0.8x the index’s valuation. MLP’s and Banks also offer >2x the income of the S&P 500 while outperforming on a capital appreciation basis.

We fully subscribe to the longer-term bull market trend, but we see indications through overbought signals that the optimistic forward path for equities is being priced in and we do expect some potential for correction/consolidation in the first half of 2025 as investors take a more sober accounting of some of President Trump’s policy proposals. High beta is in favor at present, but there is growing potential for complacency with volatility indices low. We should have a plan for taking risk out of our portfolios

Data sourced from FactSet Research Systems Inc.