The S&P 500 closed last week at an all-time weekly closing high, just off the intra-week all-time daily high with a 57-handle. The Fed came through with a 50bp cut and a call for another 50 into year end. Fed speak hence has confirmed inflation measures are cooling faster than the FOMC expected, and the full employment mandate is in focus. In other words, things are coming together nicely for the “soft landing” crowd and US equities are painting a bullish technical picture.

Our trend following Elev8 Sector Rotation Model has swung to a bullish stance and our portfolio is long traditional bullish exposures, Technology (XLK), Discretionary (XLY), Financials (XLF), and, to a lesser extent Industrials and Comm. Services. The US equity uptrend has been confirmed by the S&P 500’s price action last week. The chart below shows our intermediate term upside projection near 6150 for January 2024’s base breakout. As seen on the 3yr, weekly chart below, the14 week RSI hit levels near 80 in April and July. With price having consolidated through August, we are looking for a bullish surge into year-end on interest rate relief and election cycle optimism.

We will be taking look at our bullish bellwethers in our letter this week. Risk appetite seems to be expanding in the near-term and the low vol. side of the market is also overbought on a daily basis. We think there is potential for oversold Technology and Semiconductors shares to be accumulated, and we are watching the Discretionary sector closely. It has put together a convincing near-term reversal, but now must reverse its longer-term underperformance trend.

It’s nice to see the equity market playing it down the middle. We’ve been looking for some relief from the Fed for almost 2 years, they’ve finally come to the table with some help and equities and buyers are stepping in with a bid.

–Patrick Torbert, CMT | Chief Strategist, ETFsector.com

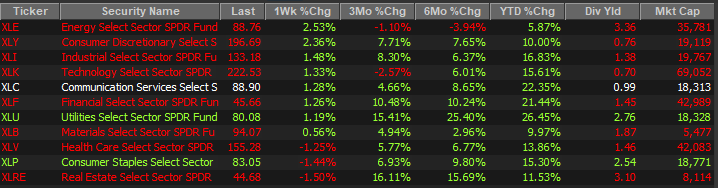

Sector ETF’s/The Week in Review

Sectors

A greater than expected cut to the Target rate was a boon to laggard sectors last week. The XLE SPDR was the top gainer despite lagging during intermediate and longer-term timeframes. Discretionary continues its nascent revival as investors expect relief from rates and from lower commodities prices. Technology shares are seen to benefit as they have been oversold in the near-term and we will be taking a closer look at those Consumer and Technology gages as we proceed.

Risk-off trading has controlled the tape Since July 16, but that could be changing.

Consumer Discretionary shares have been firming recently. The sector has been challenged for most of the bull cycle. This is at odds with much of history as Consumer Discretionary stocks typically outperform when the S&P 500 is in an uptrend as it has been for much of the past 2 years. Nonetheless, the 3yr weekly chart of XLY (below) shows that recent strength hasn’t changed the longer-term, multi-year performance downtrend for the sector vs. the S&P 500. XLY has lagged the S&P 500 by almost 17% on a simple return basis over the past 3years. There’s a chance for reflation if the Fed remains focused on consumer purchasing power and affordability. We see a retest of early 2022 highs by year end as a likely scenario.

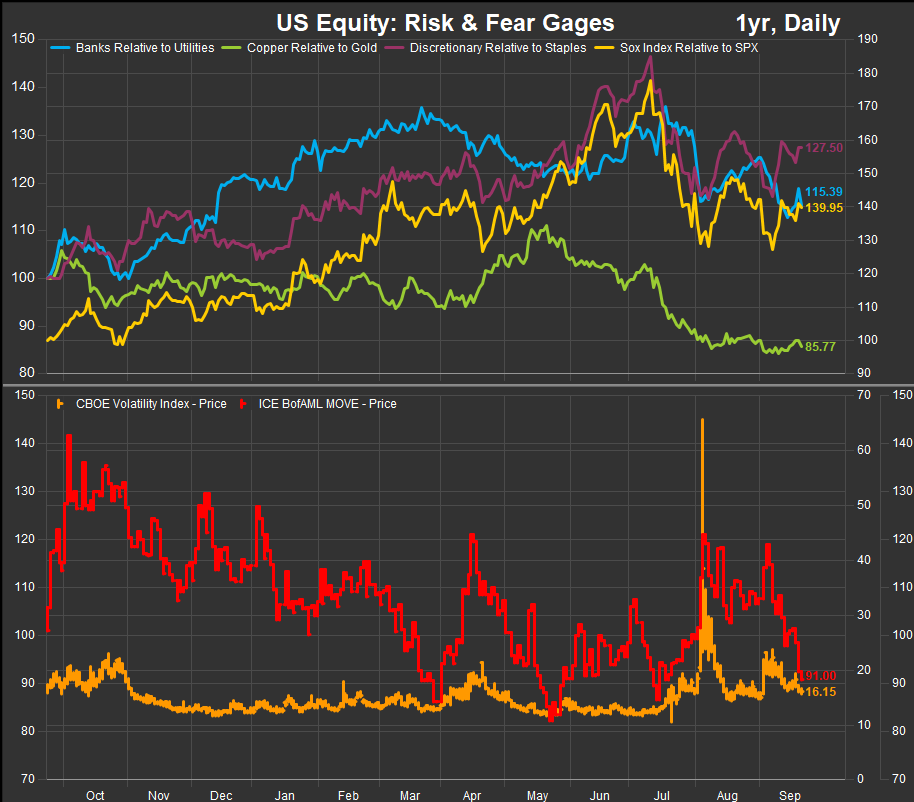

Risk gages more broadly have improved, but the bull still has work to do to regain control of the tape. The chart below features several of our preferred gages of risk-on/risk-off sentiment. Banks vs. Utilities, Copper vs. Gold, Semiconductors vs. the Broad Market and Discretionary vs. Staples help us understand the risk appetite behind investor positioning. At present we are seeing the Discretionary sector stabilize vs. Staples. The Philadelphia Semiconductor (SOX) Index is also attempting to stabilize and could be offering a decent tactical entry point here. Copper remains weak vs. Gold as commodities in general have not seen a bid materialize.

In the bottom panel of the chart, we plot the CBOE Volatility Index (VIX) and the ICE/BofAML MOVE Index which proxies bond market volatility. Both gages have collapsed to low levels of the past 3-months.

Overall, the picture for risk is improving. Interest rates would need to remain benign as the consumer won’t see any relief if mortgages don’t move lower and that means the 10yr Yield needs to remain in the 3’s.

We still have some concerns about small and mid-cap. stock performance. The Russell 2000 has shown some signs of life during the recent consolidation along with the Russell Mid-Cap., but we’d like to see both continue to improve to feel good about the breadth of the advance. The Mag7 may well have more juice left to give, but we don’t think they can continue to carry the bull trend alone. From a big picture perspective, the AI paradigm needs to be vetted with respect to its clients. We know the technology has great potential, but we’ve reached the point where the implementor has to benefit from the investment and the insight it can provide. We see some signs in the stock charts of COST and WMT, but there are many charts showing a distinct lack of investor enthusiasm. If AI is a panacea to business, we need to start seeing strong evidence of the synergies in forward guidance and improving sales outlooks.

Source: FactSet Data Systems